Our friend Tracy Shuchart (@chiglr) shared this article highlighting the reality of the “green transition.”

The coal fleet grew by 19.5 gigawatts last year, enough to light up around 15 million homes, with nearly all newly commissioned coal projects in China, according to a report by Global Energy Monitor, an organization that tracks a variety of energy projects around the globe.

The article goes on to explain:

New coal plants were added in 14 countries and eight countries announced new coal projects. China, India, Indonesia, Turkey and Zimbabwe were the only countries that both added new coal plants and announced new projects. China accounted for 92% of all new coal project announcements.

China added 26.8 gigawatts and India added about 3.5 gigawatts of new coal power capacity to their electricity grids. China also gave clearance for nearly 100 gigawatts of new coal power projects with construction likely to begin this year.

Oh, and there’s also also this (emphasis ours):

To meet climate goals set in the 2015 Paris Agreement, coal plants in rich countries need to be retired by 2030 and coal plants in developing countries need to be shut down by 2040, according to the International Energy Agency. That means around 117 gigawatts of coal needs to be retired every year, but only 26 gigawatts was retired in 2022.

As we’ve been warning for years now, the whole “green transition” is a pipedream.

But don’t think for a minute that will stop the pointy shoes from trying to push it through…

It won’t, and it is going to be difficult to escape the consequences of these actions taken, but our job as investors is to profit from the folly and inevitable shortages, crisis, and tensions (which is why we’ve been gorging on coal stocks — among other things).

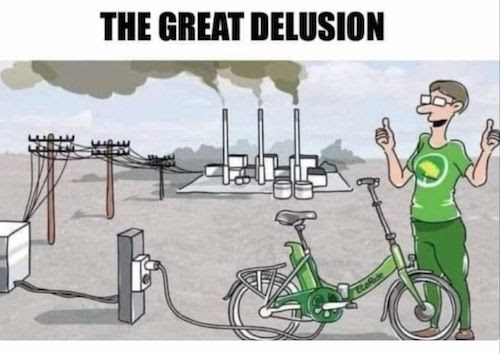

MARK MILLS ON THE ENERGY TRANSITION DELUSION

MARK MILLS ON THE ENERGY TRANSITION DELUSION

Speaking of “green” energy, we shared the following talk with our Insider Newsletter readers the other day, and figured it would be worth sharing it with you, too.

It’s a great deep dive into the reality of the energy transition delusion and well worth your time.

ALL THINGS TRANSITORY…

ALL THINGS TRANSITORY…

Feels like a lifetime ago, when — back in February 2020 — we started warning that lockdowns will bring about inflation and shortages. Fast forward to today, and this pesky stuff is now part of our daily lives. We recently set up a dedicated inflation channel in our Insider private forum, where members can share their own experiences with all things “transitory”.

A couple inflationary gems from around the world today…

First, this one from member Sean:

Crumbed cod in Jersey was £4.50 and has gone up to £6.50. Also, those Hello Fresh boxes people order for their meals, the shipping has increased from £5 to £9. The updated inflation rate is coming out in Jersey in 3 weeks so it’s should be a “good” one

Staying with fish, member Mike in New Zealand shared this photo:

For reference, this works out to $33.

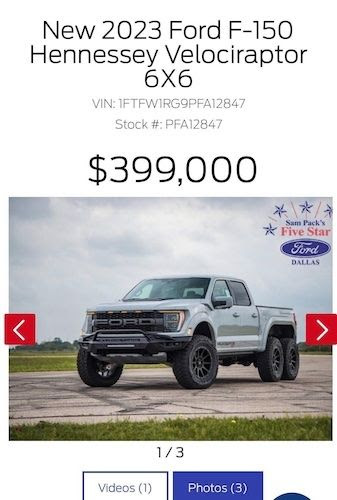

Now, let’s tack a few more zeroes on those prices, shall we? The following came from Stefan.

Want to drive a non-ESG compliant vehicle? You’ll have to pay up!

HOW TO PLAY DE-DOLLARIZATION

HOW TO PLAY DE-DOLLARIZATION

By now, you’ve probably heard about the global shift away from the dollar, so we figured we’d provide some thoughts on what’s taking place…

It’s time to ditch your dollars and try and get your hands on some renminbi or Brazilian real, right? Well, not so fast.

As Chris pointed out in a recent Insider Newsletter issue…

A move away from the USD and Western financial system, despite what you’ve likely heard, is NOT automatically bullish the yuan or the ruble (too thinly traded, anyway), and it promises to be an incredibly rocky road.

It is, however, wildly bullish for gold. You see, in order for a new financial system to be created (and the BRICs, together with the Shanghai Cooperation Organisation, are scrambling to put one in place) trust is required.

It’s not enough to be afraid of the rickety old train we’re all travelling on. We still need to travel, and the new bullet train that is desired is not built. It will be out of sheer necessity, but in the meantime it is gold that will underpin safety for foreign central banks. It’s why they’re buying so much of the stuff lately.

Speaking of gold, we touched on the topic a few weeks ago. Click here for a refresher.

CHECK OUT OUR MERCH

CHECK OUT OUR MERCH

Have a great week everyone!