There’s a bit of a hullabaloo going on at the moment about LIBOR. And in truth, it is a pretty big deal.

Yes, even bigger than whether or not Stormy Daniels got jiggetty with an old guy wearing a wig. And get this… even bigger than Kanye’s man-love for the same guy.

What is LIBOR?

Let’s start here.

Whether you know it or not, LIBOR has for decades played an integral part in the cost of your beer. That’s because it has provided a means to determine the cost of debt in everything — from student loans and mortgages to complex derivatives.

What happens is this…

A daily survey is taken from 15 of the largest banks in the world.

In this little test each bank submits a quote estimating how much it would be charged by the other banks to borrow money across a range of durations without any collateral being put up.

All the rates are then tossed into a baking dish, baked, and the pie that comes out is an average rate known as LIBOR.

It stretches across 7 different maturities and 5 currencies, and, together with Euribor, it is the primary benchmark for short-term rates across this ball of dirt we call home.

Thomson Reuters publishes it midday and pretty much the entire financial community involved in debt markets of any kind (and plenty who’re only tangentially connected) furrow their brows and sip their long blacks while scanning these very rates in order to more intelligently make critical business decisions, which ultimately affect the cost of your beer.

And so, as you can see, it is very important.

How big?

$350 Trillion!

It’s a hard number to get your head around but that’s how much LIBOR underpins in the swap, loan, and floating rate bond industry.

How It Went Wrong

Like so many bad ideas, this one probably also started in the pub. For those not familiar with norms in London’s financial district allow me to explain.

It’s mandatory that on a Thursday night you head out to a watering hole and get yourself… well… watered.

Once sufficiently sozzled, talk of how Charlie was caught in the copy room with his hand up Cindy’s skirt turns to more juicy stuff, namely the secrets held (otherwise known as “proprietary IP” by traders employers), and these are often traded as liberally as candy at a fairground.

More pints means more talk.

And why shouldn’t they be? In my experience, bankers, brokers, and traders at the behemoths care about two things. Getting laid and bonuses. And trading secrets with their mates in the pub threatens neither of those.

Even though brokers are seen as sort of second class citizens in this little world, they are in truth the ones who held the power in rate setting.

That’s because they acted as the fulcrum to the rates set. Every trade in the OTC market goes through a broker. It’s just much easier than calling up a dozen banks to get a quote when you can call a broker who’ll provide in seconds a quote and counter-party.

In any event, partly due to their getting sozzled with newfound mates (traders) at the pubs and partly because they liked receiving cash payments for “favours”, they agreed to quote rates back to other traders that were skewed. That, in turn, allowed other traders to make determinations around trades based on isht numbers.

Now, manipulating rates downward typically isn’t in any banks’ best interest as they actually typically make less money, but for individual traders arbitraging the markets it can definitely mean the difference between a bonus and a pink slip.

But that wasn’t really what got this whole fustercluck of criminal behaviour going.

As is often the case it wasn’t greed so much as fear that drove massive manipulations of LIBOR.

You see, when banks were hoarding cash as Lehman was doing its swan dive, they desperately needed to ensure they stayed alive. And that meant pretending that things on their own balance sheets weren’t quite as sticky as they actually were.

Manipulating LIBOR downwards was particularly useful as the GFC was threatening to set off a cascade of risk adjustment, which, if it’d run its course, would itself have likely set off the revaluing of those $350 trillion of global assets based on rates waaay higher than was being reported.

That’s a pretty big deal since it would almost certainly have sunk many more banks if the markets knew what their actual health looked like.

It was also a pretty big deal if you’re a trader like Tom Hayes at UBS, whose bonus relied on this NOT happening.

Now, I know I’m glossing over the mechanics of a lot of this, but the point is Tom was just one guy doing what he could in the circumstances. We all now know that it wasn’t just UBS as an entire squadron of banks have since been caught and fined for being naughty.

The Solution

There is of course an answer to this particular problem… and it’s probably not what you think.

Folks from all walks of life these days have all sorts of angst towards the bankers and by extension LIBOR itself.

There are those who yell and scream that a key problem with LIBOR today is that it’s the jooos who control it, and we all know that anything that the jooos have a hand in is clearly the work of Satan. And that’s all fine and what you’d expect. The problem with this view is that it’s daft.

Then there are those of the pointed shoe brigade who say, “No, no, it’s clear as day. We need more regulation and men with stern faces and Brook Brothers suits, who will give speeches while furiously waving their index fingers and who have the might of the law behind them”.

That’s also silly and you know why?

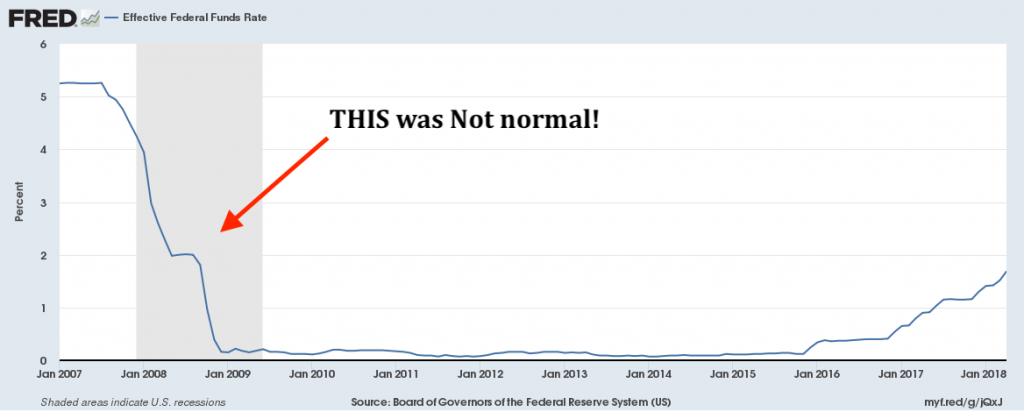

Consider the biggest manipulator of interest rates in the world.

While the rates that banks charge one another for unsecured loans provide us a great window into real or perceived risk in the financial markets, those same decisions about risk are based on many factors but easily one of THE most important of all are the rates set by the world’s central banks.

And we all know that post-GFC the level of coordination and, dare I say, rigging by those folks has been in the order of holy-mother-of-Mary extraordinary.

And now, even though the way quotes are submitted has changed since the LIBOR scandals hit the headlines and the entire process is now more regulated than an olympic sprinters’ urine, what’s causing angst in the financial community is that the banks have all agreed to get rid of LIBOR but nobody really knows what’s going to replace it.

Here are the problems as I see it…

As long as there is any group in charge of this process that’s human, they’re open to bias, influence, and wanting to buy a holiday house in the South of France.

And that means we don’t want humans involved. The core problems of LIBOR as I see them are:

- Manipulability,

- Opacity, and

- A lack of incentives for data providers to open their kimonos.

Surely the solution to this lies in taking the human element out of the equation.

I mean we could confiscate all the beer and the whole getting sozzled problem but that’s hardly fair to our fellow men, no matter how grievous his crimes. And the truth is we’re not going to change human behaviour.

No, instead we can use ideas that exist such as randomisation and encryption on a blockchain.

Heck, we’ve seen ICOs for all sorts of nonsense, but here’s one that could actually solve a real world problem that involves a whopping great sum of money.

Think about it…

If bank data submitted was encrypted and immediately randomised, making it anonymous, not only would any one particular quote NOT divulge sensitive and possibly scary information, there’d also be zero incentive to lie. What would be the point?

Then there’s the fact that distributed ledger technology involves data that is immutable.

So in case it’s not obvious, this would mean that, once submitted, the data could not be altered. And since it’s distributed, it would be stored on a gazillion computers in the cloud.

Furthermore, by settling the transactions on something like the Bitcoin blockchain, we’d be employing what is currently the world’s most sophisticated and secure protocol.

That’s important if you don’t want this thing hacked and thus manipulated. Today not one bank despite their incredible wealth have a network as robust and secure from manipulation as that of Bitcoin.

It Could Go Much Deeper

Indeed, LIBOR is all about rates, and rates are all about loans.

We could have loans that are adjusted according to LIBOR be fully automated. The syndicated loan market, for example, has already been testing blockchain loan type products. Two I know of include Finastra and Synaps Loans. I’m sure there are others.

Why should we have scruffy 20-something year-olds at only 15 of the world’s top banks dictating what short term debt goes for? In a world where we’re drowning in data this seems as outdated as the Marlboro man.

[clickToTweet tweet=”Having scruffy 20-something year-olds at only 15 of the world’s top banks dictating what short term debt goes for is as outdated as the Marlboro man.” quote=”Having scruffy 20-something year-olds at only 15 of the world’s top banks dictating what short term debt goes for is as outdated as the Marlboro man.”]

In theory we could have every participant in the loan market submitting bids on debt across every imaginable maturity. And rest assured the wonks who are building this stuff could design smart contracts to auto execute on matching orders.

This would happen based on conditions being met for any participant based on their submitted criteria, reviews of the counter parties, and any other relevant criteria. And it could all be done without any involvement from any central authority.

Now, this may all sound like futuristic, idealistic hope-speak, but consider that there exists a steady flow of intellectual capital in the finance world, and that intellectual flow is moving into one area. That area is blockchain technology.

I recently tweeted this:

HSBC says performs first trade finance deal using single blockchain system https://t.co/N3U1AyctOb

— Capitalist Exploits (@capitalistexp) May 15, 2018

The odds are better than we might think. And thank goodness for that because we sure as hell can’t trust the current folks in charge.

– Chris

“Give a man a gun and he can rob a bank. Give a man a bank and he can rob the world” — Unknown