That we’re gonna crash. You will by now have noted that the pointy shoes at the Fed hiked rates by 25 basis points.

As my buddy Tony Greer pointed out:

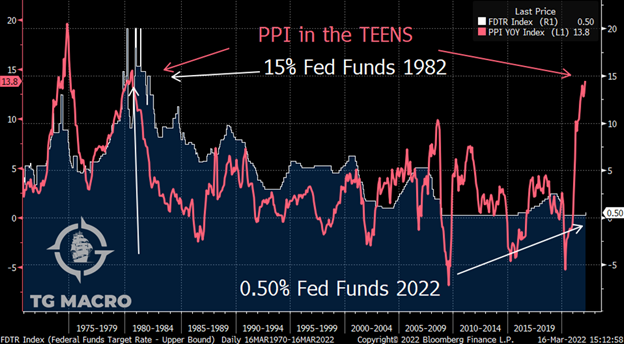

The last time we saw inflation at these levels, Fed Funds ratcheted to 15% to cool things down. Fed Funds at fifty basis points is throwing a ping pong ball at a freight train.

Clearly the Fed are way behind the curve, which is precisely what we have been saying will happen. Not that we’ve some crystal balls or anything (we don’t), but we do realise that raising rates to the point where they actually curb inflation (i.e into double digits) would destroy the bond market and with it the US government’s ability to finance its deficits. That’s not particularly palatable to those suited folks in DC who feed at the public trough. So instead we get the Fed’s equivalent of virtue signaling.

It’s completely meaningless.

Then there’s something else. The yield curve looks like it’s about to invert, which, if you don’t follow financial speak, simply means we’re going to have a recession. 100%.

As stated by fund manager Alfonso Peccatiello here:

As explained here, we often overlay cyclical growth to the poor structural growth trends using leverage – this ‘‘kick-the-can-down-the-road’’ system is sustainable only if (real) borrowing costs are cheaper and cheaper to facilitate refinancing and marginal access to new credit.

When the yield curve is inverted, the marginal cost of refinancing and accessing new credit short-term increases and often breaches the equilibrium levels required to keep the system afloat – this increases the hurdle for the private sector to access credit.

As long-term growth prospects are poor, an already indebted private sector looking at more expensive borrowing costs might even think of the ‘‘true evil’’ – deleveraging.

A vicious circle therefore unfolds: restricted/more expensive access to credit in an already slowing and poor long-term growth environment leads the private sector to be more defensive, which compounds on the already ongoing cyclical slowdown.

An inverted curve doesn’t only predict slowdowns, but it often contributes to them.

We’ve known all of this for some time, but now it looks like it’s definitely coming. That’s the probability right now.

It looks to me like stagflation. I know, I know. We’ve been saying this is the most probable outcome for over two years now, but consider what a deleveraging in credit markets looks like when it runs headlong into a brick wall of rapid deglobalisation, collapsing supply chains, war, and shortages in critical goods — what I call Maslow’s goods.

Speaking of probabilities…

This Post Has One Comment

Chris, I love your work and actually started investing in commodities over 3 years ago, as I saw a few things approaching in the world that didn’t seem right, among all the financial manipulation of the western world. I also happen to like bitcoin a lot, but it remains quite volatile, though I’m not particularly worried about it. My question for you would be how one might handle the coming equities decline if he holds a decent portion of stocks, although most are related to oil and precious or rare earths (such as uranium or lithium, copper, etc)? Should one just hold it through the decline and hope to come out of the other side less affected? I personally believe at the end of this year and into next it’ll be clear by the “mainstream” that recession is here, though we’ve basically known this for years. Sell the “paper” and re-buy later? I’m curious as to what you might think is the best route to follow.