Have you ever asked yourself what happens when you place a trade?

I hadn’t given it much thought until about 10 years ago when something happened which opened my eyes to a single company that holds what is probably the most concentrated risk position in the US market.

Here’s what happened…

So, I took a position in a private placement. The shares came free trading after a 6-month lockup, and the stock had been running like the cops were after it.

It had a half warrant attached, which was deep deep in the money, and I wanted to scoop a healthy chunk of money off the table. Heck, this was a bloody drill play which, as you probably know, are more often than not burning matches. Bright and brilliant until they burn your fingers.

So, I’m busy scrambling to get the stock placed with a broker so that I can trade it.

First up was a very well known broker whose name I’ll keep out of the spotlight (I like the guys and gals there and it’s not that important). I’ll call them broker X.

I have an account with them and they said, “Sure, no problem.” A week later, “Ah sorry Sir, we’re having some questions from compliance.” And then another week passes and “No, so sorry, we can’t take that one.”

I can’t remember the reason now but at this point I’m two weeks down, the stock’s “en fuego,” and I’m getting antsy. I quickly call my broker at Sprott and they took the stock. This took only a couple of days.

Now, with the stock placed I’m free to trade it. And I do. The same day, I pull up my account at broker X and looky here. There is the original stock sitting in my account. Wait! What?! That can’t be. So I pull up my online account at Sprott thinking someone slipped my something in my drink but no…there she is. This is voodoo, or magic, or a cock up. It’s in two places at once.

I’m sure if I hit the sell button at broker X their back office will spasm, and before the bean counters can have a heart attack the system will vomit up the true position. Plus, I’m not an ass and knowing the truth I can’t in good conscience do that. I only own a certain position, not double it as much as I might wish that was the case.

Down the Rabbit Hole

And so this is what led me down the rabbit hole of actually looking at what takes place when you place a trade.

I contacted broker X and we finally sorted out the problem. They performed their accounting magic and the position disappeared from my account but this is where it scared the isht out of me.

When I asked my broker how did they typically account for client positions I was told that the Depository Trust & Clearing Corporation (DTC) holds the securities.

All securities I asked?

Yes, all. Or at least 99.99% of all outstanding securities. So broker X (and indeed all brokers) have an account with the DTC, and the two accounting systems need to match, showing “brokers’ clients'” securities, which need to reflect the securities held at the DTC on a netted basis.

Ok, I got it. It’s a central clearing house. Duh. I’d just never really given it any thought until that day… and it was then that I instantly realised the truly massive concentrated risk.

Massive Concentrated Risk

When you buy a stock, you think you own it. But you don’t. What you own is an IOU to your broker dealer. Much like your bank deposit isn’t yours because that, too, is an IOU from your bank. Anyone who’s ever been caught in a bank run gets this. And anyone who’s even read about one gets it.

So like a traditional bank the DTC acts in a similar way. By the way, in Europe Euroclear and Clearstream perform exactly the same function as the DTC does in the land of apple pie.

The DTC was actually formed back in the 70’s after the back-office scandals at that time. It was a solution for the increased trading volume on Wall Street, which had become too much to handle, with brokerage firms falling behind with mountains of paperwork, and trades taking forever to clear, and counter-parties not knowing when, where, or who.

The result was that the Wall Street firms could more easily track shares by having to deal only with themselves and the DTC. Companies were and still are eliminated from the process.

So now when a listed company you own look at their share registry, they don’t see your name in there. They only see the DTC. And when brokers trade stock, all that happens is a ledger entry at the DTC with a netting taking place. You just own a derivative. Lucky you.

In fact, if you own an option contract, or a warrant, or any sort of derivative, you own a derivative of a derivate. Fun heh!

But That’s Not All

Lots of crazy isht can take place here. For example, instead of executing a trade in the market (where it’s transparent) brokers can transfer shares between clients and book the trade as a sale.

Transparent? Not so much. Sure, they’ve an obligation to get you the “best” price in the market, but how’s that possible without actually putting it up for sale in the market?

Brokers can and do also lend out your shares to someone who wants a borrow in order to sell short the stock. Often you don’t even know about it….small print, being…well small.

Imagine someone borrowed your car because the car park attendant lent it out to them. His job being the safe keeping of your car, and here he is making money by lending it out. If that doesn’t make you livid, you’re a weirdo. For the rest of us we’re none too happy.

Now, this brings up another super crazy setup.

Imagine this: You buy some Tesla stock (silly I know, but let’s play the game). You think you own it. You even report it to the tax man. Your broker reports it on his balance sheet, too.

But then he lends it out to a short seller who goes through another broker who, too, reports it on his balance sheet. One security is being reported by multiple parties on their balance sheets. Fractional reserve banking in the securities market.

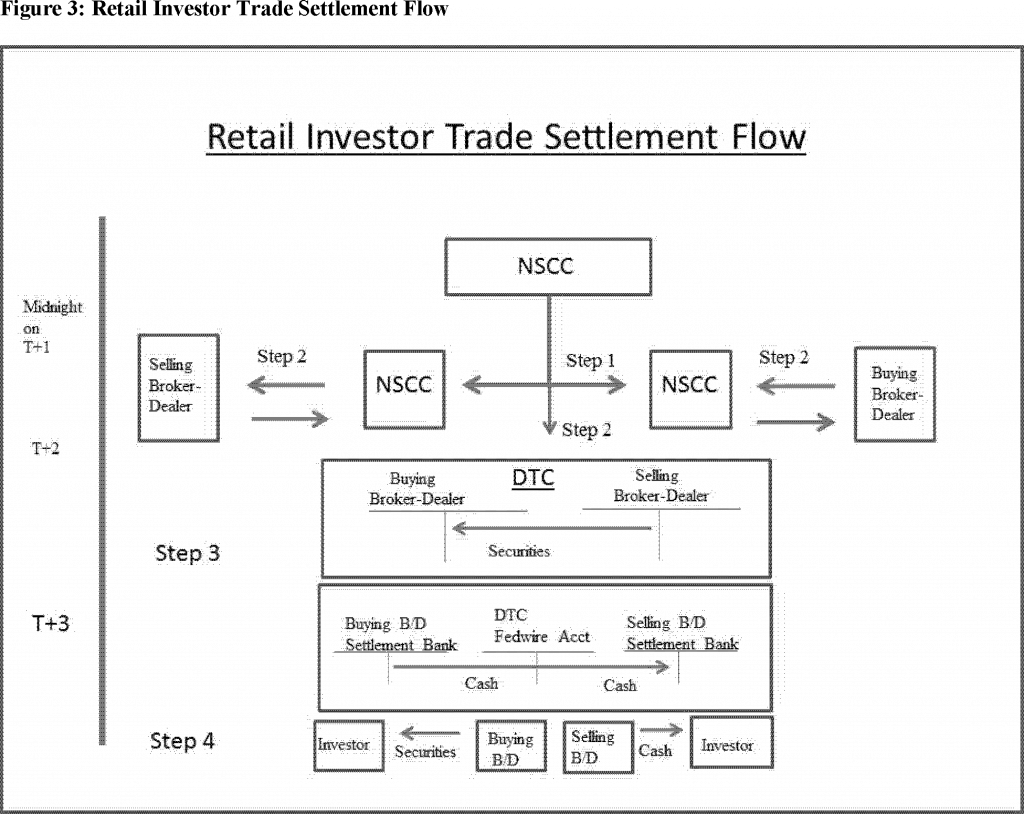

In fact, there are 5 separate institutions in each trade. Your broker, who processes to the custodian, then from the custodian to the DTC, who then process to the next custodian, who then process to the broker on the other side. No wonder it takes 3 days to settle a trade.

Thank heavens these institutions in this daisy chain aren’t levered and at risk of failing. Imagine they were levered.

Oh wait… What am I saying? I’m sorry, I’ve not had my medication.

So we buy and sell with our fingers crossed that in the trade settlement process (either T+2 or T+3, which I dare say is horse and buggy slow) nothing goes wrong to screw up our trade, leaving us with an IOU from the next Bear Stearns, Lehman Brothers, or MF Global.

Of course, once settled we’re still left with this queasy feeling in our stomach because we’ve got this entity that holds trillions of dollars of stocks, bonds, and derivatives. One single entity. Think about that.

This entire fustercluck of a setup hasn’t really changed since the early 70’s. Think about what that actually means. Here’s technology from that time.

There’s a reason we no longer use this stuff. It’s antiquated.

And this brings me to something else I’ve been harping on about here: Cyber security, where I showed you this:

Consider recent data hacks in the corporate sector:

So would someone, anyone potentially, be hacking the DTC?

Is the Pope Catholic?

When every security is held in one centralised location, is this not the epitome of concentrated risk?

[clickToTweet tweet=”Holding every security in one centralised location is the epitome of concentrated risk.” quote=”Holding every security in one centralised location is the epitome of concentrated risk.”]

There is, however, an answer to all of this mess…

“Put all your eggs in one basket… the handle’s going to break. Then all you’ve got is scrambled eggs.” — Nora Roberts