To want to own gold can be a strange and terrible affliction. What incites such an urge in the otherwise sensible and rational investor?

Why do we listen as the would be “gold guru” in his poorly fitting suit, hair slicked back in a twirl of pomade, climbs to the podium in a darkened corner of some third-tier mining conference?

He tells… no, preaches… to onlookers for the hundredth time, or maybe the thousandth (no one’s really counting anymore) that gold is just about to go to $2,000 and ounce… or maybe, just maybe $10,000!

We just have to hold on… a little bit longer.

Gold is a bizarre thing, but any object that can entrance generations for thousands of years deserves to be taken seriously.

It was hoarded in the halls of the Aztecs and Inca, its potency having outlasted that of their gods. It decorated the tombs of Egyptian Pharaohs 5,000 ago and lines our microprocessors today.

For every true believer kneeling before the altar of gold, there is an equally righteous heretic full of vehement contempt for the metal. The strongest of these are the apostates, they once believed, but then flew too close to the sun – and got burnt. Now even the mention of gold, or those preaching it, fills them with indignation.

There is probably no other commodity that can incite such polarized emotions. Observing it is a master class in human psychology (and rival’s reality TV for entertainment value).

In gold, like many things, I’m an agnostic. It’s a commodity, and it’s cyclical. There are good times to buy gold… and there are great times to sell. But I do know, for a fact, that when the gold price runs gold equities go F@#cking nuts.

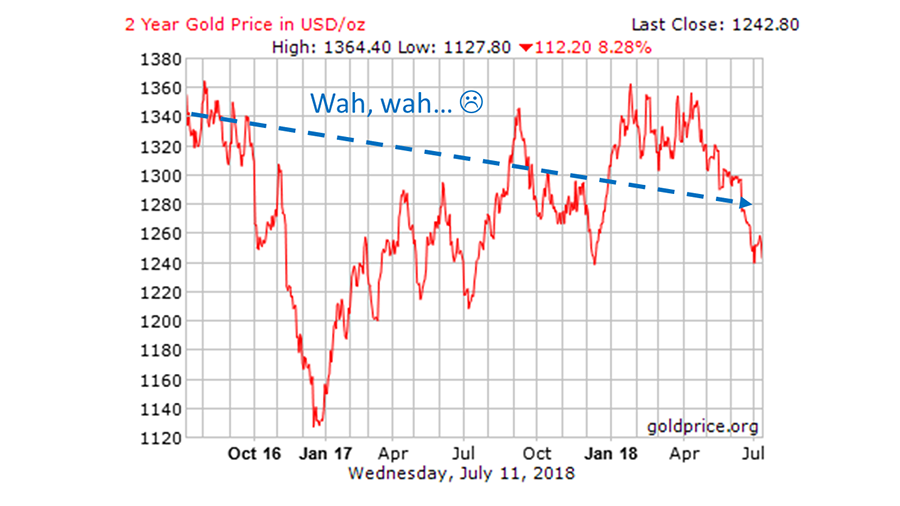

We last had a small taste of this in the summer of 2016. Here we saw the gold price increase by 30% from $1,060/oz to $1,360/oz. And gold equities? They jumped by over 150%.

That is 5x the rate at which the commodity increased.

Is this a reasonable price movement? Not particularly.

Should it be happening? Probably not.

Does it happen? YES. Relatedly and consistently.

Is gold an excellent store of wealth? Probably.

Is it a viable alternative to traditional fiat currencies? Err… maaaaybe.

But having a pile of gold bars under the floorboards of your basement in case of a zombie apocalypse is not what we’re talking about here.

Then, are gold equities a good investment? It’s complicated.

I don’t espouse to complicated theories on metal price predictions, most people who try to do this are wrong, the rest are lucky (or just consistent for long enough). Instead I subscribe to the Occam’s razor approach: The simplest answer is generally the best one.

There are a few things that we know:

- People want gold.

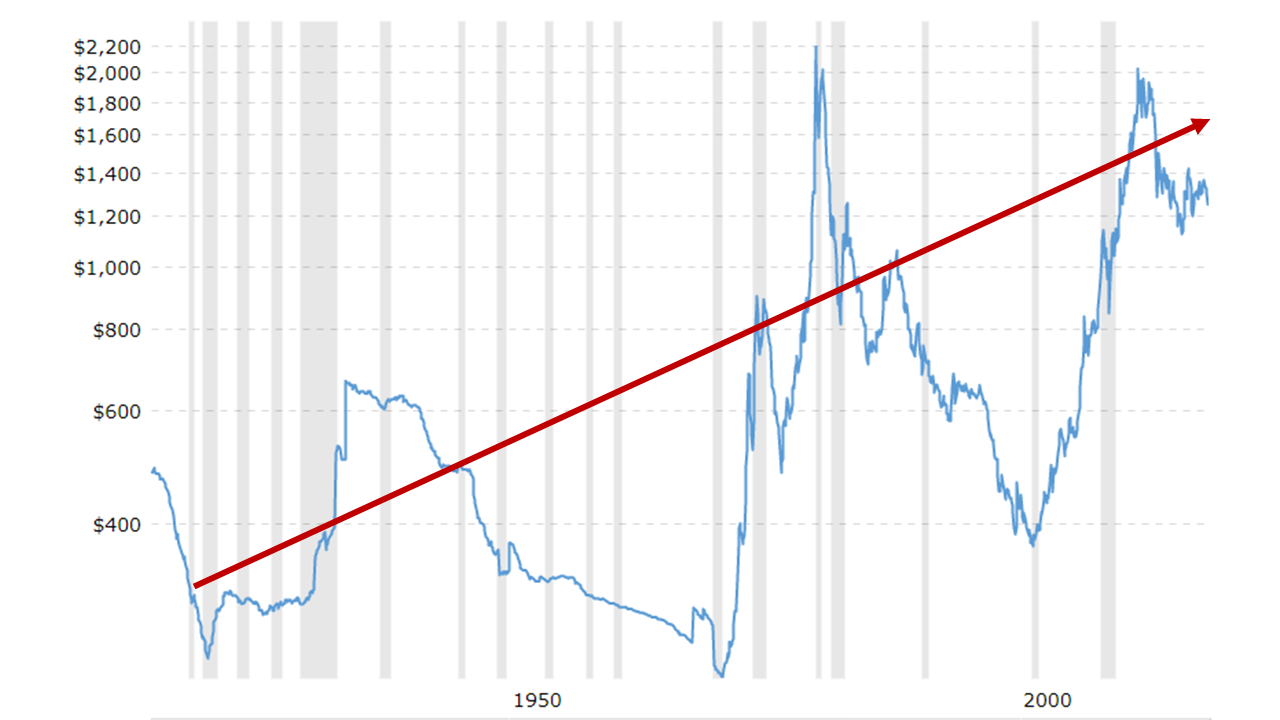

- Though cyclical, over the course of time gold tends to go up.

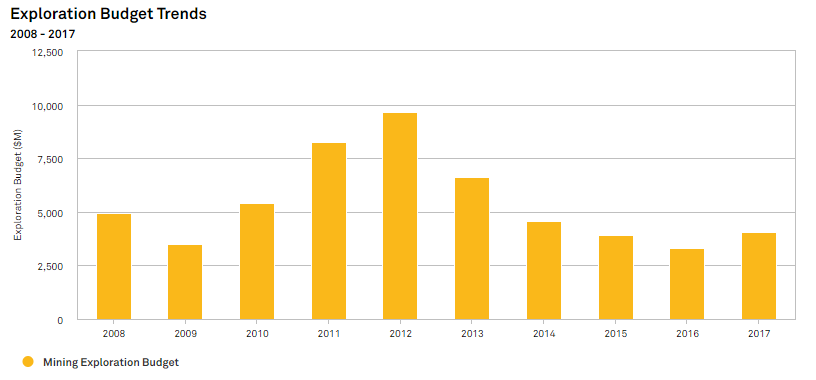

- The price of gold is low enough that many mines are no longer profitable and little exploration has been completed to replenish depleted global reserves.

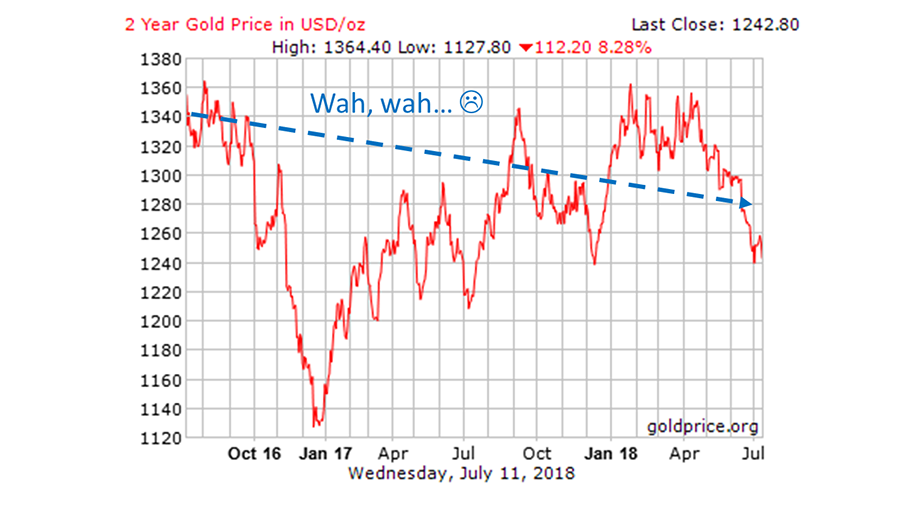

- The price of gold has been stagnant to weak for the last two years.

- The price of gold tends to thrive on disorder and uncertainty.

Because of all these things I like gold now. Some day that will change.

Why not just wait until the price starts to move up you say? That’s a good question.

If you’re able to time it perfectly then you should do just that… but if you’re like the rest of us mere mortals, it’s probably better to be too early to the party then too late.

I believe we’re due for a run in the near to medium term, because of this view I’ve been spending a disproportionate amount of my time thinking about gold discoveries.

Exploration and discovery is where you get the most leverage to the gold price, it’s also an aspect of the industry that’s been sorely neglected the past decade. When the price of gold goes up, people are going to want more of it. When they want more of it the best projects are going to be worth more than they are today… a lot more.

All the Right Places

A few years ago, I was chatting with a friend, an exploration geologist, on where we could expect to find the world’s next big gold discoveries. Without skipping a beat, he said: Côte d’Ivoire.

He’d spent years exploring in West Africa, in particular Burkina Faso (The Ivory Coast’s neighbor). When I asked him why he said:

Simple, Côte d’Ivoire has more greenstone belts then Burkina Faso and it sure as hell doesn’t have of the same number of mines.

He went on to say that years ago, various international aid organizations had offered Burkina Faso and Côte d’Ivoire funding and they could direct that funding towards either a geological survey or an agricultural program.

Burkina went with the geological survey, while Côte d’Ivoire went for the agricultural program. Initially this looked like the right call, in the 1960’s and 70’s Côte d’Ivoire went on to become the agricultural powerhouse of the region. Then markets took a hit and the country was thrown into economic turmoil followed by years of political strife and civil war.

The story stuck with me.

I found myself coming back to Côte d’Ivoire again and again. Looking at maps, checking out projects, picking the brains of friends and colleagues who’d worked in the area. There was clearly gold there, someone just needed to put in the work to find it.

When the opportunity to invest in a huge West African land package presented itself, I started to get serious and dig deeper.

Despite being the most geologically prospective country in the region Côte d’Ivoire produces a fraction of the gold of its neighbors. Years of civil war, a previously thriving agricultural industry, and a decidedly anti-mining government has effectively kept international mining companies out… but that began to change when Alassane Ouattara became President in 2010 and began opening the country up to mining companies and explorers.

Today, most of the easily found mines have been found. The next generation of projects are technically challenging, or they’re located in places that miners haven’t historically had access to.

Côte d’Ivoire falls into the latter category. And therein lies the opportunity.

West Africa

West Africa is one of the most prolific gold producing regions on the planet. This is largely thanks to a massive geological formation known as the Man-Leo shield. The shield hosts a rock type known as greenstones which are famous for containing orogenic gold deposits.

For the non-geological reader out there, suffice it to say that greenstone belts are very good. They host some of the largest gold deposits on earth, and are the backbone of major gold producing regions in Canada, Brazil, and Western Australia. Geologists love them, they know them inside out, and more than a few explorers devote their entire careers to looking for orogenic gold in greenstones. Their exploration and exploitation is a time tested process.

The value of West Africa’s greenstone belts, in particular, cannot be overstated. Ghana, Mali, Senegal, Burkina Faso, Côte d’Ivoire and Guinea count their combined in the ground gold resources at nearly 10,000 tonnes (321,000,000 Oz) of gold… That’s about $402 billion dollars of value. (Côte d’Ivoire’s GDP is $36b for perspective)

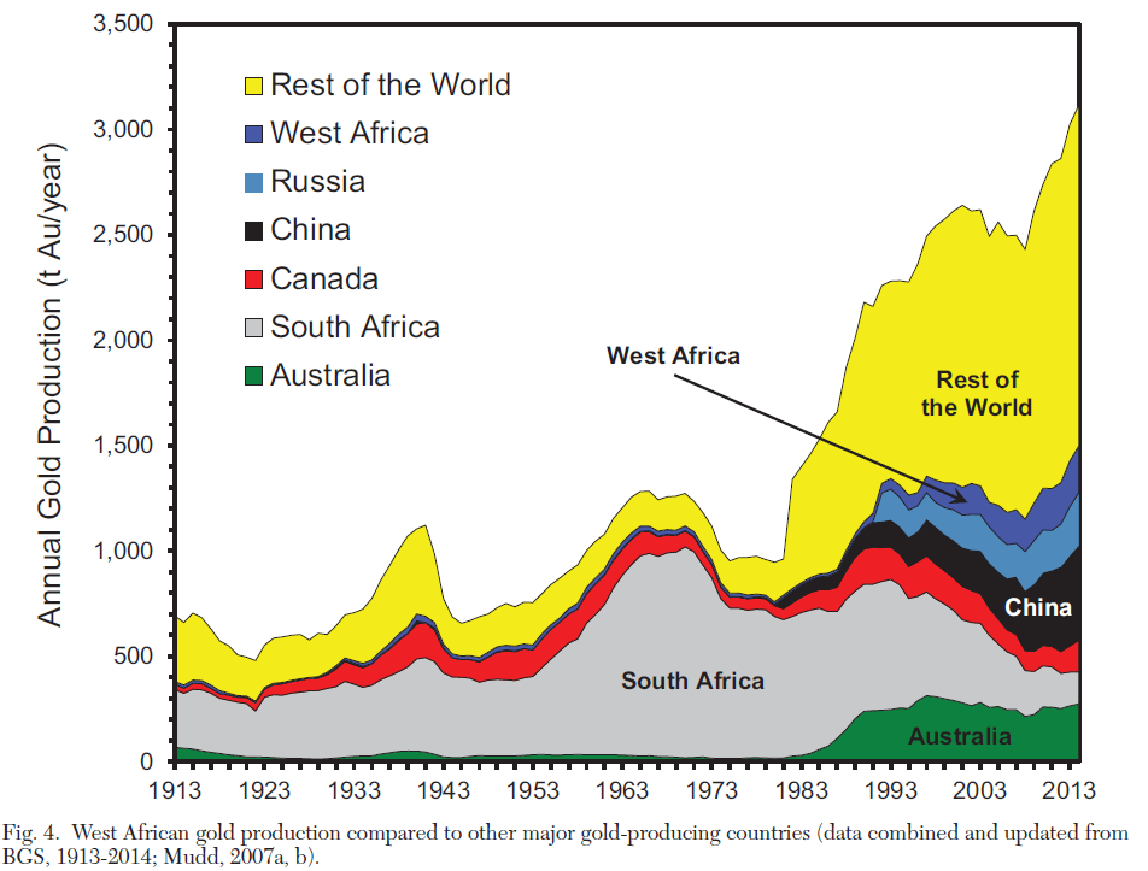

Add to this the fact that over the past 100 years nearly 5,000 tonnes of gold has been pulled out of the ground and you begin to understand that the Man-Leo shield is massive, and on par with the biggest gold camps on the planet.

The major difference?

West Africa Got Off to a Slow Start

Modern mining began in the region in 1895 when Edwin Cade purchased a stretch of Ghanaian mining concessions that would go on to become todays AngloGold Ashanti. Before this, most of the mining in the region was artisanal (think pick and shovel) but the introduction of large scale equipment, bulk open pit operations and the use of cyanide extraction changed the game. Add to these advances a regional railway and gold mining in the region took off.

A similar greenstone region in Western Australia had a 15-year head start on the Man-Leo, but the production gap has closed over the past two decades.

West Africa is now responsible for around 8% of global output and only China, Australia and Russia exceed West Africa in annual gold production.

Today there are hundreds of mines across West Africa and dozens of international companies operating and exploring in the region. Here are a few that come to mind quickly:

The Missing Piece

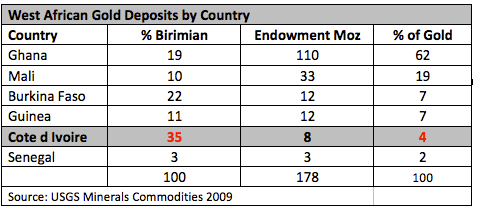

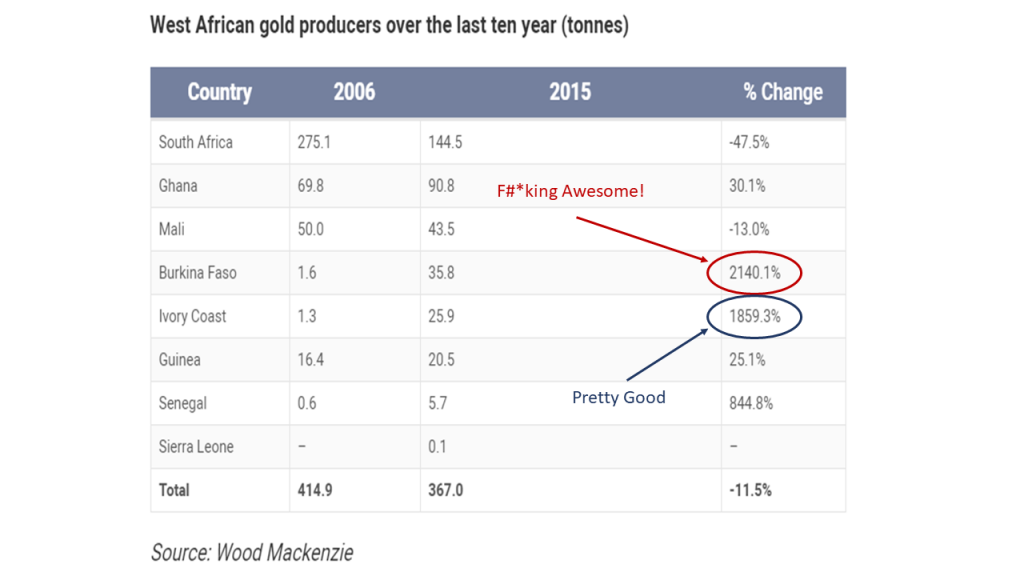

These figures don’t tell the full story, as Côte d’Ivoire is starkly underrepresented.

As the above table highlights, of the six most prevalent gold bearing West African nations, Côte d’Ivoire contains the largest portion (35%) of perspective greenstone (AKA. Brimian) rock but only 3% of the known gold.

Same rocks, different results. Meaning the country is significantly under explored when compared to it neighbors. This can be attributed to three factors:

- A country lacking a tradition of geological science and exploration;

- Sustained periods of social and political unrest; and

- Dense jungle and ground cover that can make exploration activity difficult.

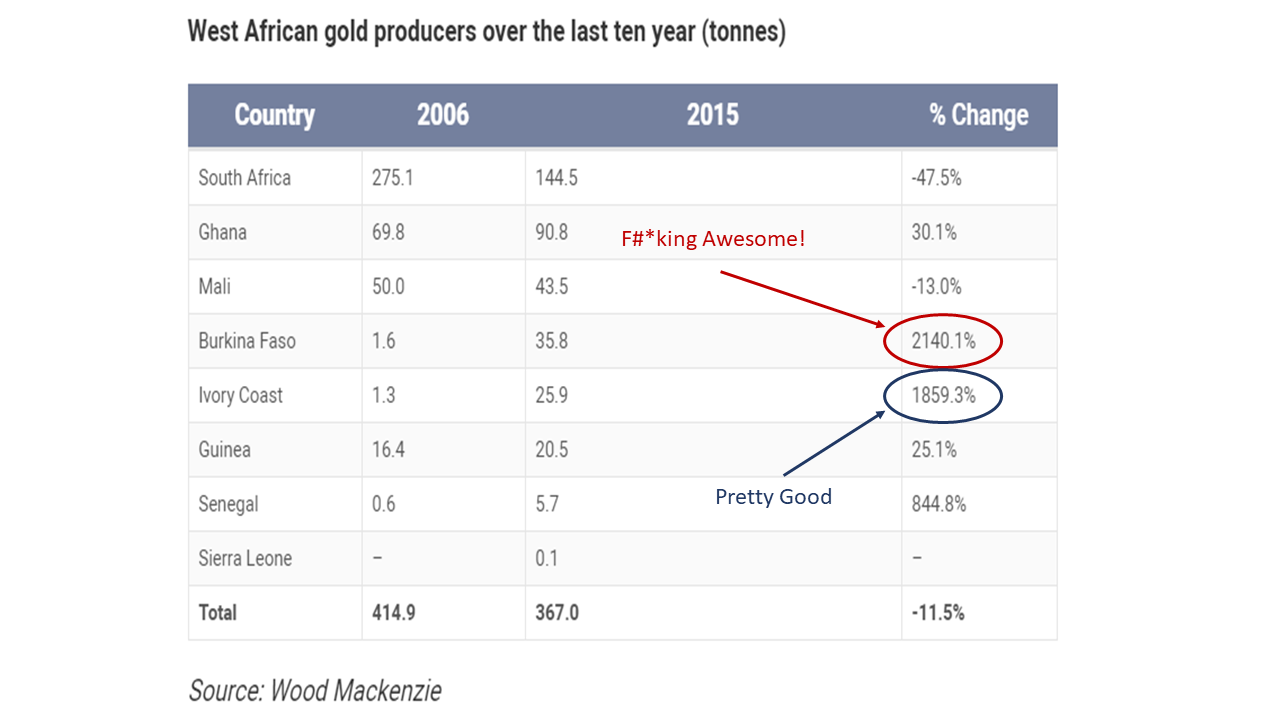

Under Ouattara’s watch this is starting to change. Between 2006 and 2015 the number of gold producers in Côte d’Ivoire has increased by nearly 1,900% (!!).

This is impressive, and can largely be attributed to Cote d’Ivoire increased receptiveness to miners. But it’s not nearly as impressive as Burkina Faso, a county with less geologically prospective ground and more mines.

Less rocks, but more mines…. Why?

Because Burkina is one of the easiest places to explore, develop and operate a mine in the world. A CEO friend of mine who permitted, built, operated and sold a mine there in under 2 years put it to me like this:

In Burkina the government bends over backwards for the mining industry. And the people in country love mining, they know where the money is coming from!

This lag in development between Cote d’Ivoire and its neighbors is an immense opportunity for ambitious explorers. The gold is there, someone just needs to go find it.

But, West Africa is not Canada or Australia. There are risks, there are challenges, and there are coups d’etat. The poverty can be stifling, and the issues accompanying it overwhelming.

But that is where the gold is.

And this, dear reader, is the great challenge, and opportunity, of the mining business: You go where the mines are, not where you want them to be.

Great teams can navigate tough issues, and the right deposits make the challenge worth it. Worth it for management, worth it for the countries they operate in, and worth it for shareholders.

An Enormous Opportunity… Literally

When a friend reached out and suggested I invest alongside his VC group in a West African exploration play I was hesitant. West Africa is extremely prospective, but as discussed there are real challenges. But this friend has been something of a mentor to me, I trust this judgment, and it doesn’t hurt that he’s one of the most successful early stage investors in the space.

So, I dug deeper; and I started where I always start the team.

I was happy to see management checked my number one box – They’ve done it before. The VP of Exploration has held a leadership role in four successful projects in the region. The CEO has been a banker, and the head of corporate development for a successful company: He looks at deals for a living, he had a great job and was making good money, and this is the opportunity he chose to put his name on.

The rest of the crew are old African hands who know how to get things done in the region.

The next thing that caught my eye was the shareholders, the primary backers is one of the most successful royalty and streaming companies on the planet. They’re in for a royalty on the land package as well as equity in the company. They have a reputation as a supportive shareholder, that backs the teams they work with, and as a group that comes up with creative solutions to challenges.

And the most important part? A massive land package.

At the Exploration Stage Size is King

There is a reason Robert Friedland famously told geologists to “Stake all of Labrador!” when they had their first hit on the multibillion dollar Voisey’s Bay Mine. Finding a big mine is hard, you need space to move around, to figure out what’s going on at a macro scale; and you don’t want to end up owning half of a deposit. Big land packages are absolutely essential to success, and this group has a staggering +2,000km2 in a highly competitive region.

The land also happens to be split in two distinct packages between Burkina Faso and Côte d’Ivoire. Not only does this provide a platform for discovery in two of the most prospective countries on the planet, it significantly reduces the geopolitical risk, as the company is no longer beholden to a single jurisdiction.

Work completed to date has been promising and includes several high-grade drill intercepts and a very promising soil sampling program that identified numerous large targets. Add to that a history of artisanal mining in region, and the signs point towards serious discovery potential.

This leads us towards one of the most crucial, and least considered facets of any mining opportunity:

The Exit Strategy

What do they do if/when they find something? The beauty of this part of the world is that there are numerous well established, very experienced miners operating just next door, always ready to snap up new deposits in their neighborhood. Add to that a slew of others looking to get a foothold in the region and the potential for strategic investment and eventual takeover is high.

After several conversations with friends who have worked in the region, many of whom it turns out had already invested for the reasons discussed above, it was clear that this was exactly the type of deal we look for at Resource Insider:

Highly prospective, led by an experienced team aligned with shareholders, backed by reputable financiers in it for the long haul, at a great value.

And investors won’t find it anywhere else…

If you’re interested in getting access to this project, and others like it across the natural resources sector, I’d recommend joining Resource Insider now.

Cheers,

Jamie Keech

Co-Founder, Resource Insider