We’ve discussed why commodities are so damn cheap and why you need to own gold miners, not gold bars. Today we are going to talk about the benefits of private placement investments and how they can offer outsized returns.

In this article and video, I discuss:

- What are private placements?

- How can they benefit your portfolio?

- Real examples in our current portfolio; and

- How to gain access to these opportunities.

See the video here:

Private Placements… What are They?

A typically a private placement occurs when investors purchase new shares directly from a company, as opposed to buying them from another investor on a stock exchange.

These opportunities are usually not available to the general public, and the best private placement “deals” tend to be exclusive, with more demand for shares than available supply. The investors that get first dibs on this stock tend to be well connected or well known.

There are two types of private placement investments common in the mining industry:

- Private Investment in Public Equities (PIPEs); and

- Private Equity Investments.

PIPEs

In a private placement into a public equity, investors are buying newly issued stock directly from a publicly listed company. The money goes directly to the company, which can then be used to fund work that should increase shareholder value.

Because investors are buying the stock directly from the company and not from a stock exchange like the TSX or NYSE, the company is able to sweeten the terms of the deal to incentivise investors.

This typically takes the form of:

- Selling stock at a discount to the current market price;

- adding warrants; or

- sometimes both.

A warrant is essentially a stock option that is issued directly to investors from the company. Warrants will have a strike price at which you can buy the shares and an expiration date that you must execute your purchase before.

Private Equity Investments

Private equity is a type of investment where individuals own a portion of a company that is not publicly owned, quoted, or traded on a public stock exchange. The main types of private equity investment strategies are leveraged buyouts, venture capital, and growth capital injections.

At Resource Insider we are focused on venture and growth capital investments.

A venture capital investment involves taking an equity stake in an early stage private company that is not yet profitable, but it has high growth potential.

A growth capital investment entails taking a minority stake in a relatively mature company that is looking for capital to expand or restructure their operations. These types of businesses are more mature than venture capital investments, but do not generate enough cash flow to fund their own expansion.

Private investments can be done at any price the company and investors agree upon and commonly include warrants.

Benefits of Private Placement Investing

Due to the illiquid nature of private equity, share prices are not quoted very often. This allows a company’s value to hold steady in times of market volatility (like now), because all of the investors are committed to the long-term strategic growth focus, and they cannot liquidate their equity stake.

Most importantly, private investments often come with better terms than you will find on the open market. This in essence is a reward for investors for supporting the company early and accepting a higher degree of illiquidity.

In the junior mining world investors participate in private deals of this nature because they believe that they are getting into a great “deal” at a better price than they could get on the stock market. Often these types of deals will be “re-rated” when they list on an exchange, meaning that they go up in value, thereby rewarding early investors and providing them with liquidity (a chance to sell their stock at a profit).

To better understand how these types of investments can benefit investors, just look at two current holdings of the Resource Insider portfolio.

Alpha Lithium (TSX.V: ALLI) Private Placement

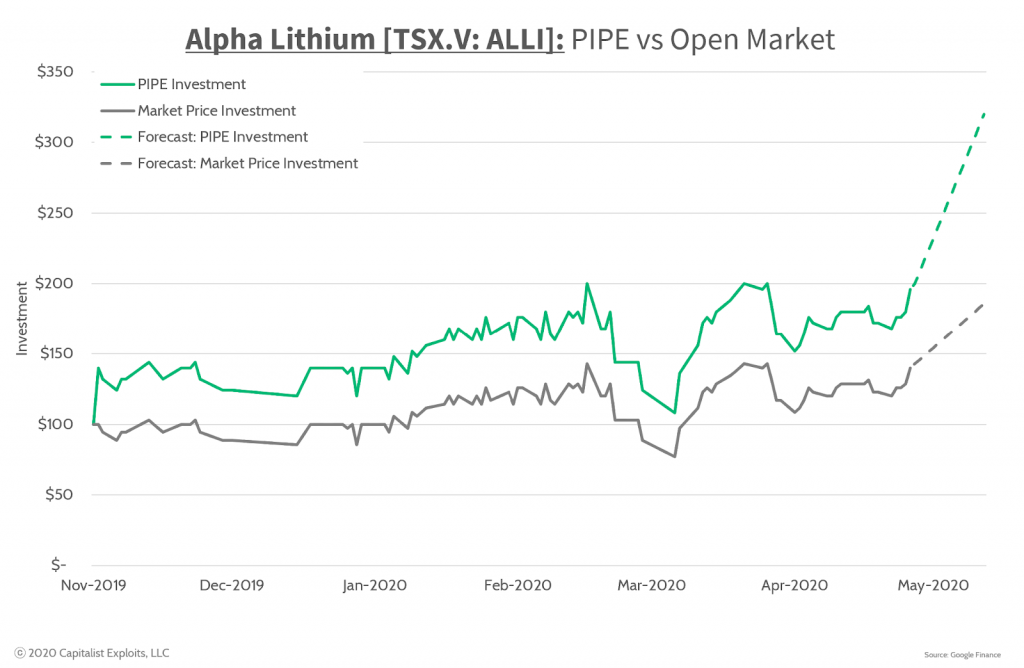

In January 2020, RI members completed a PIPE investment into a lithium company called Alpha Lithium (TSX.V: ALLI). In this deal, we invested at $0.25 per share while the publicly listed stock was trading between $0.30 and $0.40 per share.

This private placement also contained a full warrant for every share purchased, with a “strike-price” of $0.50 per share and an expiration date of January 24, 2022.

That means for every share an investor purchased they have the right to buy a second share for $0.50 for the next two years. If the share price goes above $0.50 any time in that two-year period investors will make money on these warrants.

If the share price goes to $0.75, they make $0.25 per warrant, if it goes to $1.00, they make $0.50 per warrant, and so on.

The chart below compares a $100 investment in the private placement described above vs. a $100 investment in shares bought at market price. The dotted line shows the further return disparity as the share price increases above $0.50 per share.

As you can see – participating in PIPEs can be a force multiplier for your invested capital.

Eclipse Gold Mining (TSX.V: EGLD) Private Equity Investment

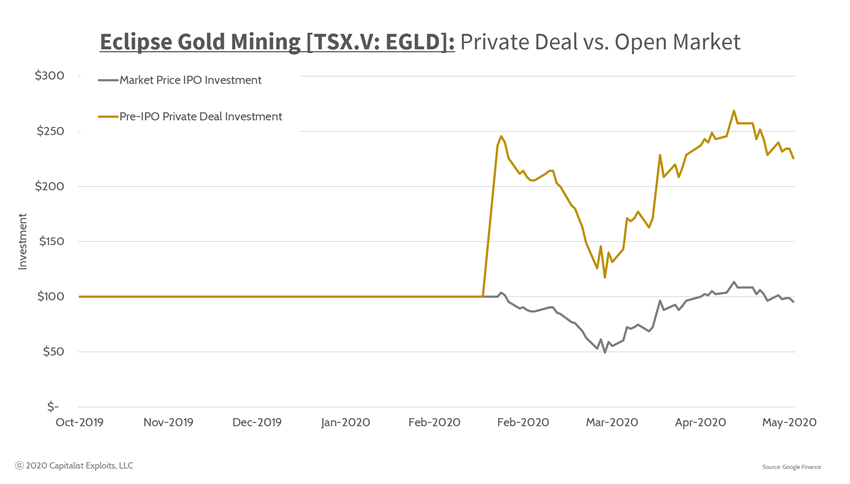

The second example is a private equity investment in a gold exploration company: Eclipse Gold Mining (TSX.V: EGLD).

RI members invested in Eclipse in the fall of 2019, and it went public, listing on the TSX.V, in early 2020. Because we were able to invest privately, our valuation was much cheaper than the listed price. Our members invested at $0.35 per share, and the company quickly ran to over $0.80 per share within a week of listing and over $0.90 a few months after that.

The cheap entry price provided investors with a strong buffer on the open market as COVID-19- related volatility hit, allowing us to remain profitable at the worst of times

Below is a chart comparing $100 invested through the private equity investment vs. $100 bought on the open market at IPO.

This is a big gap, and the opportunity to capture these types of returns is why Resource Insider is focused on private placement deals.

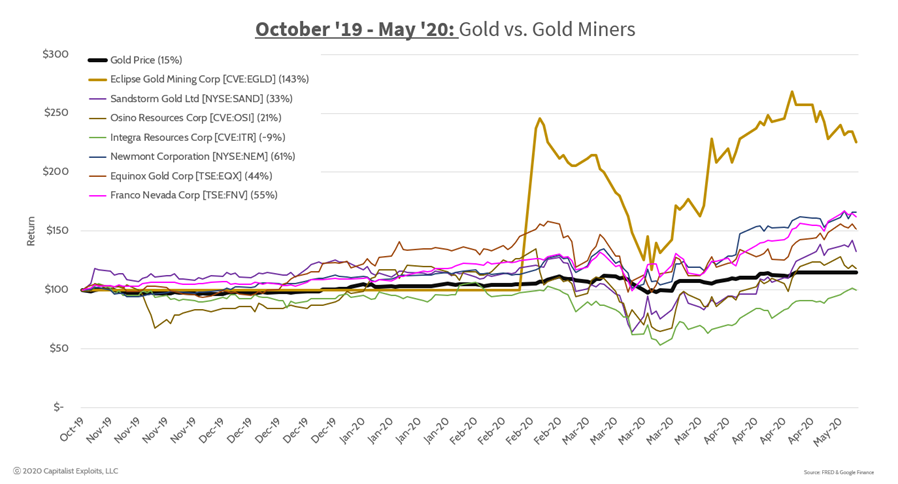

But, how did this investment compare to other publicly listed mining companies during the same time period?

Eclipse Gold provided our members with significantly better returns than they would have received through buying many well-known stocks on the market during this period.

How to Access Private Placements?

Many of the wealthiest and most successful investors in the mining space made their money largely from participating in private placements.

At Resource Insider, we leverage our connections and long-standing relationships within the natural resource sector to provide our members with access to some of the most exclusive deals available.

This is one of the ways we add outsized gains to our portfolio – by investing with proven teams, into great assets, and benefiting from an opportunistic investment structure.

If you want to see how we’re managing our own capital and learn about our upcoming deals, check out Resource Insider and sign-up for our free email list here.

Cheers,

Jamie

PS. Sign up for Resource Insider now to learn about the upcoming gold deal that Chris MacIntosh and I are investing our own money in.