I don’t know if you saw it but the Ruskies fell out of bed with the head choppers Saudis last week.

As my friend, Mike Alkin, recently mentioned on this chat (join if you dare).

Interesting times, indeed.

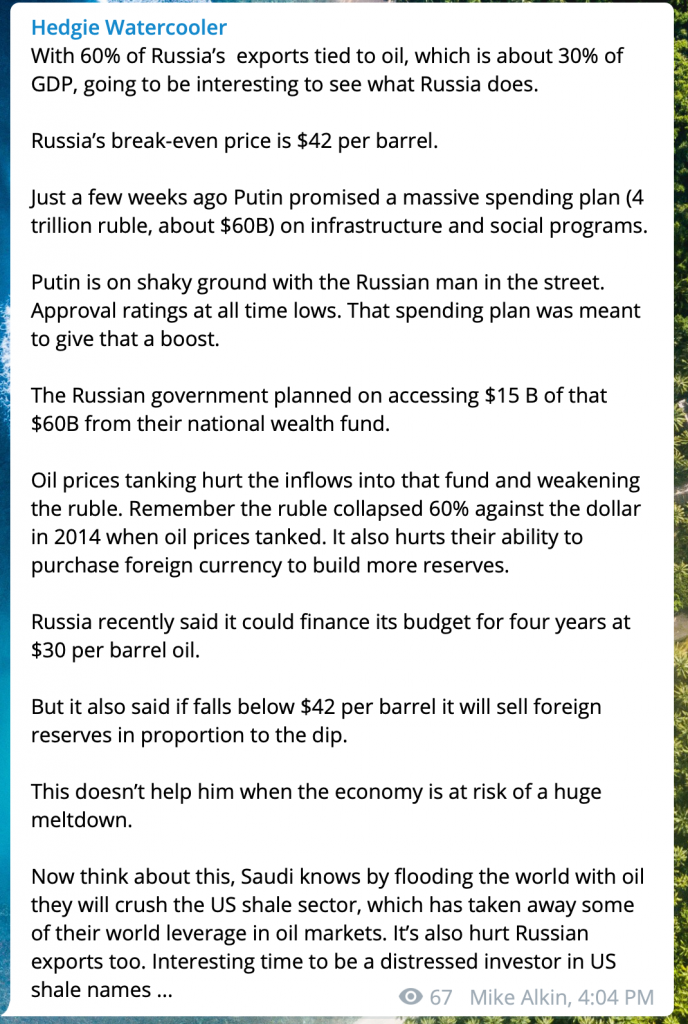

Here’s Occidental, a pretty good barometer for the US shale industry.

Still, if you think that’s ugly, do yourself a favour and have a gander at their bonds which have gone no bid. Shale…as I’ve mentioned many times before, was a bug in search of a windshield. OPEC’s collapse simply accelerates the inevitable.

But that’s not what this article is about. This one is about currencies.

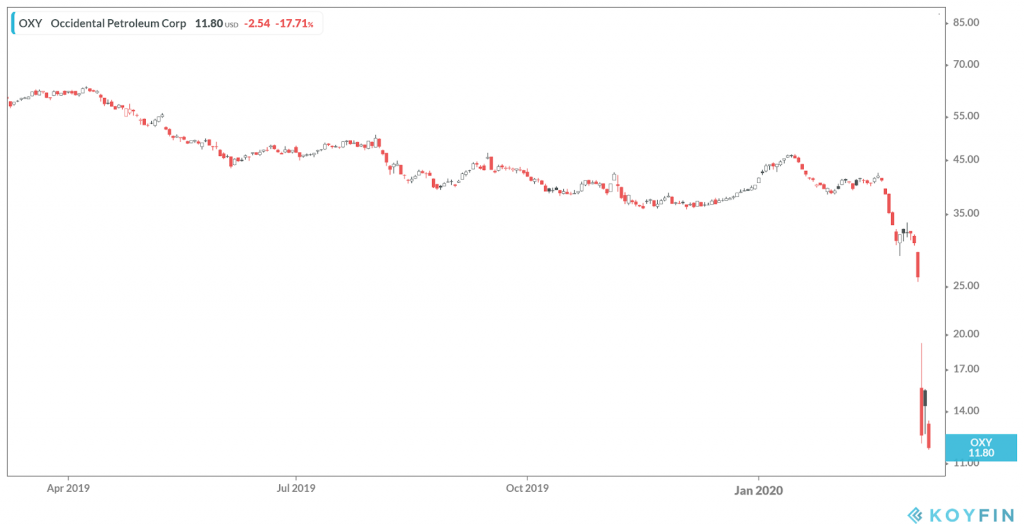

And here’s the Dollar vs the Ruble.

Currencies always provide a release valve for stress, and the Ruble did just that.

There is a lot at play here. The Russians have no particular love for the Saudis, which is not surprising, given they’re presently at war with each other via proxy in Syria (and Saudi is losing). And as Mike points out above, Russia’s economy relies on oil as you and I rely on oxygen. The same thing is true of the Saudis who are in an equally awkward spot.

Which explains why, when left at the altar by the Ruskies, they promptly abandoned their original plans to cut production, and announced to us all that no…they would abandon any attempts to limit supply and instead go full throttle at an increasing market share…which is to say driving down the price of oil and wiping out the competition, including those bloody Russians. Damn them.

We’ve been harping on about how the geopolitical world would fragment, and now a black swan – which is what the coronavirus is to the world – is showing the fragility of these relationships and accelerating this process. Right now, we’re seeing it internationally between the Ruskies and the head-choppers. But perhaps the real risk, yet unspoken, is the domestic threat to these countries at a political level.

The Saudis (and by Saudis, I, of course, mean Bin Salman), and the Ruskies (and by the Ruskies, really, I mean Putin) have the same problem that China (and by China, I mean Xi) has. They’ve all concentrated so much power in one person that when anything goes horribly wrong, (and it’s just gone horribly wrong for all three of them now) then they become a lightning rod for dissent.

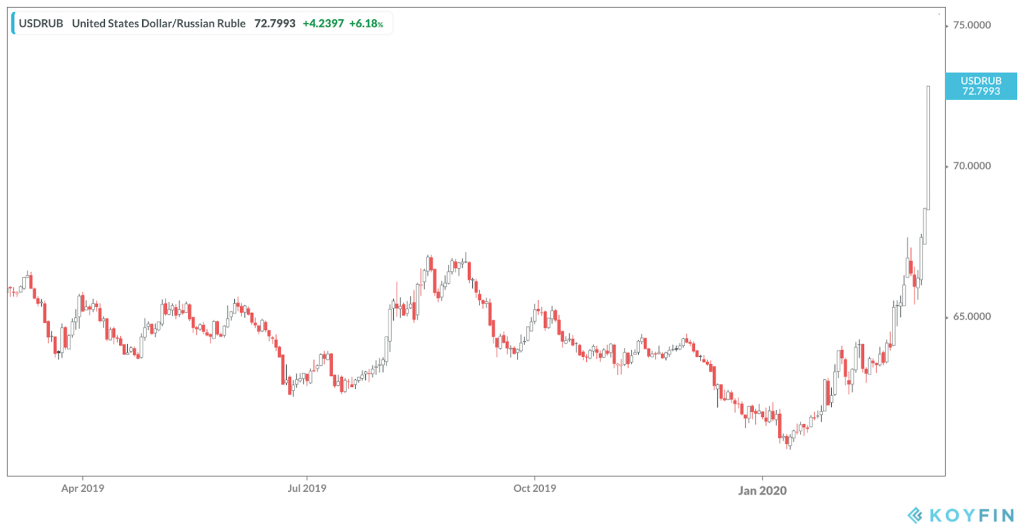

As this pertains to the head-choppers, it’s worth remembering that they keep the populace in line with a combination of – funnily enough – chopping heads, peppered with some pretty solid social spending. And it’s the social spending part that really needs factoring into this equation. With the price of crude dropping, Bin Salman is still going to need to balance the budget, which means the daily lolly scramble that allows him to stay in power must go on.

As for Putin, as Mike Alkin mentioned above. He needs more than $42 oil to get those lagging approval ratings back up. Otherwise…well, you know the deal – unrest, truncheons, snot flying. Not good.

China.

As I mentioned in a previous article on the coronavirus as it relates to China:

As you can tell, Xi has a similar problem. Economic growth and an increasingly wealthier Chinaman and, yes, Chinawoman (I’m not a bigot) are baked into the implicit agreement that the CCP has with the Chinese people. It’s a two-legged agreement. Which has been – you stay in power and we get richer. One of those legs just got pretty wobbly. And don’t think that within CCP ranks there aren’t other psychopaths scheming to upend Xi’s lifelong rule. Psychopaths are attracted to political power like Greta is attracted to Vegan steaks.

All of this is to say that all three of these countries have immense pressures now on them.

And this is the part where asymmetry presents itself. That’s because only one of these countries currently has a release valve. I’ve already showed you the ruble. That’s the one.

Now, take a look at the Saudi Riyal.

Oh, wait, that’s an ECG on Jeffrey Epstein.

Here, try this.

In case you’re wondering, THIS is what a pegged currency looks like. Volatility? What volatility? Exactly…there is none.

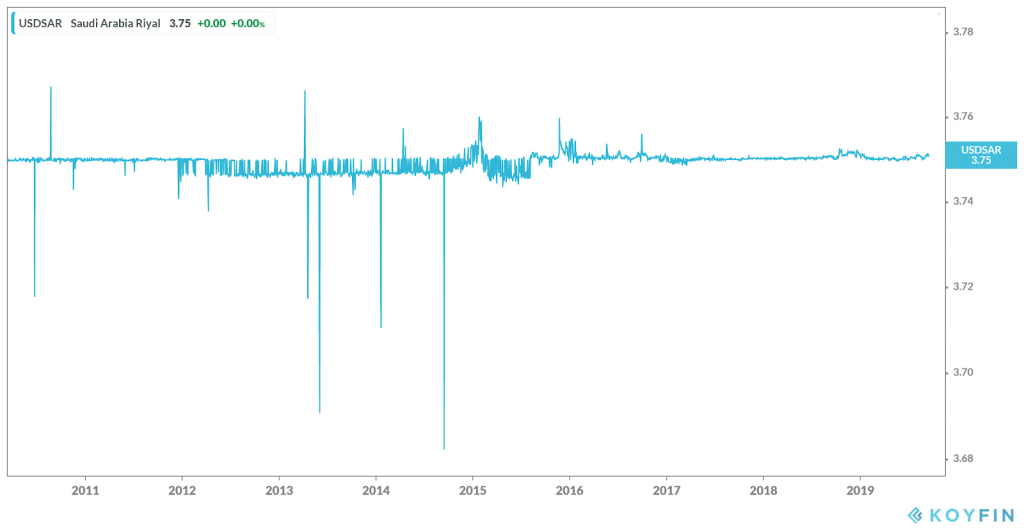

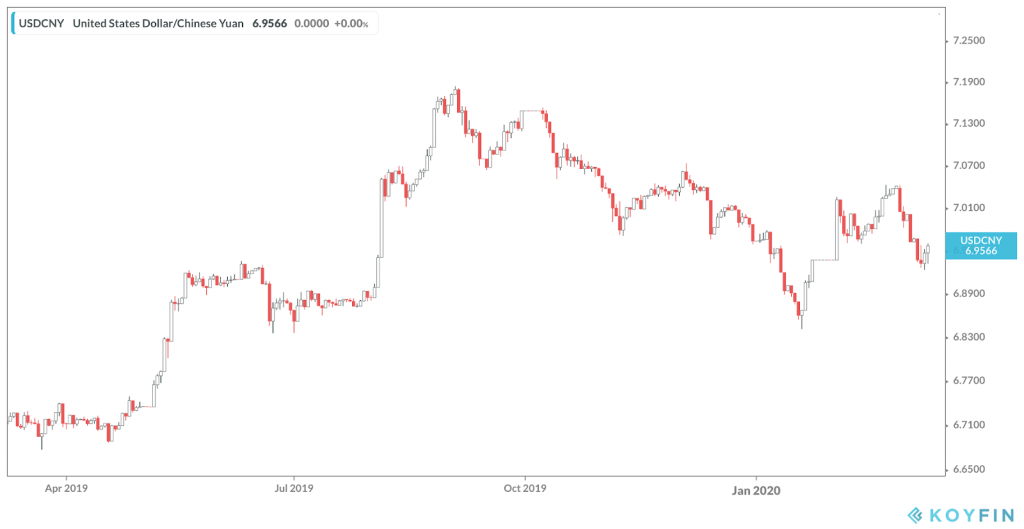

Here’s the Yuan.

Hardly moved. Imagine that.

I don’t expect it to stay that way.

That is all. Take care and don’t get that nasty virus.

-Chris