My little girl came into my office the other day and was looking over my shoulder. Suddenly she ran out of the room calling to her brother. “I know Dad’s password! I know Dad’s password!”, she yelled. “What is it?”, my son asked? “It’s 8 stars.”

Sometimes we look at things believing with sincerity we know and understand what we’re seeing. But we’re really as dumb as a box of rocks.

This brings me to our “trusted” friends at the rating agencies.

In March of this year Fitch took out their big rating agency stamp and hammered a AAA rating on Australia:

“Australia’s ‘AAA’ rating is underpinned by the economy’s high income, strong institutions and effective governance. The free-floating exchange rate, credible monetary policy framework, low public debt and growing recognition of the Australian dollar as a reserve currency allow the economy to adjust to changing economic conditions.”

Reading rating agency reports is like being immersed in a warm bath, with a glass of hot milk, while being read Winnie The Pooh and Peter Rabbit. You feel all warm and fuzzy inside but it’s one big fairy tale.

Let me take a necessary sledgehammer to the above statement.

“The economy is underpinned by high income, strong institutions and effective governance.”

Actually there are 4 pillars underpinning Aussie economic growth:

- The investment bubble in mining. Many of the high incomes have been tied to the mining boom. This is now over.

- Sales of exports to China which, while still there, have been falling steadily thanks to a hollowing out of the manufacturing sector.

- Government spending, which they keep promising to cut back on. Ha!

- Rising mortgage debt.

Of the 4 pillars above the only one still rising is mortgage debt. Pillars should be built of concrete. This one is built from polystyrene and it’s holding up the economy.

I’m struggling to understand how an economy increasingly running on the over consumption of real estate financed by mortgage debt is anything but insane?

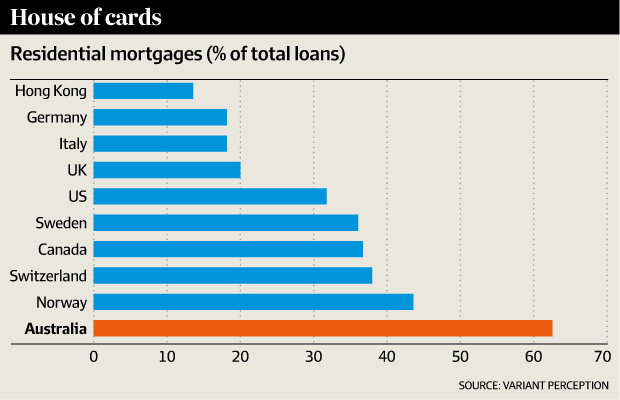

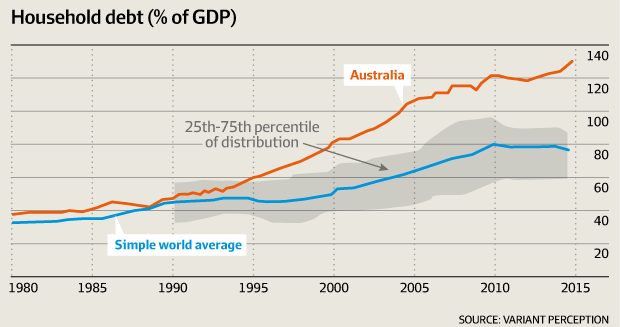

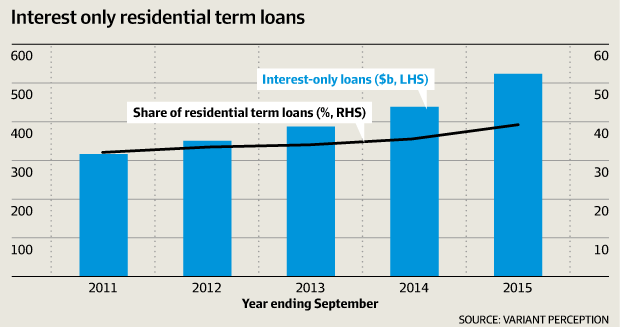

For those of you who think in pictures, Jonathan Tepper of Variant Perception did his own analysis of Australian real estate and provides some excellent graphical representations of the problem:

Move on, nothing to see here. Remember, Australia is different. It’s the lucky country.

Or is it?

High prices in themselves are not a problem so long as they are relative to high incomes. An executive living in NY, earning $500,000 a year, and living in a $1m house is the same as an executive in Kansas, earning $100,000, and living in a $200,000 house.

But over in the “lucky country” incomes bear no sustainable relationship with asset prices:

For context. Back in the 80’s private sector debt to GDP was 20%. Today it’s a whopping 95% while total household debt (mortgages, credit card debt, consumer loans) clocks in at 123% of GDP – the highest in the world.

Household debt has now grown to 125% of GDP. This is only a problem if you think history repeats. If, on the other hand, you subscribe to the “we’re different because the weather is better here” theory then stop reading now because the rest will just have you hurling insults at me.

Let me remind you that Ireland and Japan had ratios of 3.5 times GDP at the very peak of their respective booms. Right before epic busts that “nobody” saw coming.

So how is this mother load of debt financed?

Nearly half of all mortgages in Australia are now interest only mortgages. Oy vey!

The only reason you’d pay interest only on a mortgage is if you were letting the property and receiving a positive yield or if you simply couldn’t afford to make principal payments. Since yields are strongly negative, we know borrowers can’t actually make principal payments.

The banks tell us they’re just fine but their loan books are so heavily biased towards residential real estate at a time when the manufacturing sector is being completely hollowed out. The way it’s supposed to work is that incomes drive asset values (not the other way around). None of this will end well.

Sustainable?

According to Fitch (and Winnie the Pooh), it’s perfectly fine.

The next point made by Fitch…

“A free floating exchange rate, credible monetary policy, and low public debt.”

Let me tackle monetary policy first. Everywhere in the developed world it’s incredible.

incredible

ɪnˈkrɛdɪb(ə)l

adjective

1. impossible to believe.

As for a floating exchange rate: when I grew up there was a regulation that all kitchens by law had to have two exits. Most household fires begin in the kitchen and nobody wants to be trapped. You need an exit. And a free floating exchange rate is like the kitchen back door. It is the proverbial exit valve.

When investors see fire, they bolt out the “kitchen door” and the exchange rate is repriced.

It is true that public debt is relatively low, however private debt, as I’ve shown earlier, is outrageously high. The US mortgage crisis had little to do with public debt and it still rocked the world.

And then there’s this…

…growing recognition of the Australian dollar as a reserve currency allow the economy to adjust to changing economic conditions.

Where to start?

Adjusting to economic conditions?

Do they mean China, commodity prices, the emerging market slowdown, relative outperformance of the US economy, US interest rates tightening cycle, and the pending Aussie housing crash?

If so, they certainly have some adjustments to contend with.

And so despite what Fitch may have to say I’m eyeing an entry to short the Australian dollar and here are 5 reasons why:

- The USD bull market (as discussed here, here, and when explaining how the carry trade works), is not over yet. This is de facto negative for the Australian dollar.

- When the rest of the world is loosening monetary policy and the Fed are either not hiking or hiking the synthetic yield difference becomes self reinforcing.

- With $2 trillion in household debt, on the back of a $1.6 trillion GDP, the RBA will continue to slash rates. In so doing, the yield differential that the Australian dollar has been enjoying evaporates. Traders who have gotten used to playing the AUD/USD carry trade will have no incentive to do so, thus reversing capital flows.

- Everything that Australia makes, sans housing stock, is under pressure as China grapples with a domestic credit bubble and excess capacity.

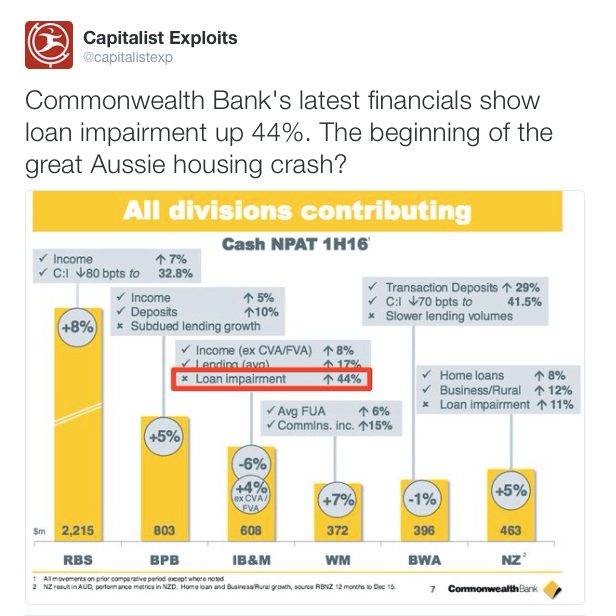

- As I tweeted back in February, Australian banks are beginning to see an increase in loan impairment.

Banks are going to find that hiding the real story is going to become increasingly difficult. Maybe Fitch should take notice.

I’ve seen Australian houses and believe me, they’re just as boring as houses elsewhere in the world. And despite what the fine folks at Fitch have to say on the matter, Australia is not A-OK.

While Australia has certainly been the lucky country: sporting good weather, littered with commodities, an educated workforce, and even Kylie Minogue, there are some major imbalances which need to be worked out. With an open capital market and floating exchange rate, a housing bust will only add extra juice to a currency which I believe will weaken regardless.

– Chris

“Think it over, think it under.” – A.A. Milne, Winnie-the-Pooh