Our friend and partner Mark Schumacher recently brought what I feel is a fabulous undervalued opportunity to my attention. Mark is both the President and founder of Thinkgrowth, a boutique investment advisory firm in Massachusetts and a contributing editor to our investment alert service.

Mark’s last short sale trade on a ridiculously overvalued marijuana bandwagon jumping, debt laden, overly-hyped company, which our Trade Alert members were alerted to on the 21st Jan, is down over 20% already, with a long way to go if he’s correct.

Over to Mark…

——–

Whatever label you choose to give it – Crisis Investing, Turnarounds, Buying Panic or Deep Value Investing – purchasing an asset after its value has been crushed has historically been very profitable, especially over a three year holding period. Let’s call these ‘washouts’ because all the weak hands have effectively been ‘washed out of the asset by the time it forms a bottom so far below its previous high. On July 25, 2013 we published a write-up discussing the advantages of investing in washouts; here were the key findings (historical returns) from the referenced study:

Average 3-year nominal returns when buying a down sector (since 1920s):

Down Avg. Annual Return

60% = 57%

70% = 87%

80% = 172%

90% = 240%

Average 3-year nominal returns when buying a down industry (since 1920s):

Down Avg. Annual Return

60% = 71%

70% = 96%

80% = 136%

90% = 115%

Average 3-year nominal returns when buying a down country (since the 1970s):

Down Avg. Annual Return

60% = 107%

70% = 116%

80% = 118%

90% = 156%

Notice that the returns in the second column are NOT the total earned over a subsequent 3-year period; they are the average annual returns earned in each of the subsequent 3-year periods! The beauty of this strategy is that it can be applied to groups of assets such as countries, sector and industry funds or to individual companies or commodities, thus providing a very large pool for researching potential washout investments.

For the majority of our clients we are working on setting aside about ten percent of the growth portfolio for investing exclusively in a handful of washouts. Funds/ETPs are preferred because the multiple holdings within the funds eliminates security-selection risk, i.e., picking the right sector but the wrong company. However, individual names will still be considered for turnaround potential. Our research will emphasize out-of-favor, basic-needs assets or businesses over high-tech stocks because despite a few spectacular turnarounds, technology is a minefield characterized by short product life cycles and a long list of crushed stocks that never recover in any meaningful way. Still, we are looking at all asset classes and companies with stock prices down by 70% or more.

Washout Idea – Energold Drilling Corp. (EGD.v and EGDFF)

The washout candidate I am currently focused on is Energold Drilling Corp. which provides mineral and oil/gas contract drilling services to a large number of mining companies all over the world. Although this service fills the vital and growing need for miners to replenish reserves, this is a highly cyclical business. Energold’s revenues come out of mining companies’ exploration spending budgets – an expense line-item which responds to cycles in commodity markets. More specifically, to the cycle of profitability and profit forecasts of big miners, which in turn is driven by underlying commodity prices. Those underlying prices are most heavily influenced in the near term by fast-changing swings in demand, because supply levels change more slowly.

The business/revenue cycles in mining, and by extension mining services, are more severe than most other sectors. My theory is that this stems from the fundamental nature of supply and is therefore a permanent condition. Increasing supply (building mines) is (a) capital intensive and, (b) requires long lead-times, so supply cannot adjust to demand swings (in either direction) in as timely a manner as happens in other industries. This causes steep multi-year cycles of feast or famine for all businesses in this sector. No matter how well or poorly these businesses are managed (especially with respect to capital allocation and hedging) they still get cycle-whipsawed because industry volume and pricing is determined by what phase of the cycle you are in at any given point in time.

That’s how the business/revenue cycle works, but there is also the target asset’s price cycle (typically a stock price), and the two are NOT the same. As severe as the business cycle is on company revenues/margins, the stock price cycle is characterized by even greater volatility. For us as investors, this is the cycle that matters most and it is imperative to avoid getting caught up trying to predict revenue changes based on industry data or forecasts.

Our strategy of buying after massive stock price declines is an attempt to bottom fish, and when stocks are near this point there typically is no data-centric model to indicate when business is about to improve. In fact, ‘forward-looking’ information such as backlog, budgets, planned spending, purchasing surveys and industry-wide sentiment will point to further deterioration in business conditions when the stock is at its lowest level.

Bottoms typically have business environments characterized with the following attributes:

- Multi-year, industry-wide, double-digit revenue declines;

- Multi-year, industry-wide net losses;

- Industry-wide backlog at multi-year lows;

- Industry-wide stock piles at multi-year highs;

- Underlying commodity prices at multi-year lows and trending down;

- Boring and shorter earnings conference calls with fewer questions;

- Analyst having gloomy near-term forecast and issuing stock downgrades;

- CEOs emphasizing cost-cutting initiatives, flexible business models and talking about their balance sheets.

Contrary to reason and prudence, which at a stock’s bottom, both say… ‘don’t invest now; wait a bit; there are no signs that things are about to get better; the situation may get worse; there will be plenty of time to invest once things start improving…’ This is actually the ideal time to buy shares. Remember, everyone else also sees how bad things are and has a bleak outlook, therefore stock prices are as low as they are going to go even though business conditions will likely worsen.

The asset (stock) price cycle bottoms before the business cycle bottoms! This is when we want to start building a position. Our working guideline is to look for the terrible conditions listed above, then make the first half-sized investment after the asset price has fallen by at least 70% from its high point, with a view to make the second half-sized investment should the price drop more than 80% from its high.

Why buy Energold Drilling today at $1.62?

Let’s use a short check list to summarize our thinking:

- Current business conditions for independent mineral drillers and their mining customers closely encapsulates the items listed above.

- Energold’s revenues began declining on a YOY basis in Q3, 2012, have continued declining YOY through 2013, and in my opinion will decline YOY through at least the first half of 2014. Net losses followed the same pattern but began in Q2, 2012. I think the entire 2014 calendar year will be one of revenue struggles and operating losses for Energold and the entire sector. Today the outlook for the business cycle is bleak, creating the perfect time to buy into a washout… when nobody else wants to.

- In the most recent earnings conference call, Energold’s executives indicated that there were no signs of significant improvements in industry conditions and that pricing pressure will likely continue. They further talked about their flexible cost structure (which in my opinion just failed the test) and how their strong balance sheet will help them be a “survivor” when the downturn eventually ends (this, I very much agree with), but it is the fact that they are talking about “survival” that’s telling. CEO’s are generally optimists, so when the best they can come up with is “we will survive” you’re near the cycle bottom.

- Energold’s stock qualifies as a washout having dropped $4.28 or 76% from its high of $5.64 reached 2/27/12 to a low of $1.36 on 12/17/13. At today’s price of $1.62 the stock is down $4.13 about 70% from its high point.

- At $1.62 the Company’s valuation is compelling, with a total market capitalization of $73M it trades for just 58% of its $125M book value, and a shade below its $75M in working capital as of Q3, 2013. Book value and working capital will both decline in 2014 but even so, the stock is cheap relative to its net assets.

In addition to qualifying as a washout, I chose Energold rather than an ETP, or one of its competitors such as Major Drilling primarily because:

- I believe the company is conservatively managed and they have demonstrated an ability to organically grow their business and gain market share through past cycles, and;

- due to a sizable stock offering completed at $5.20 per share near the cycle peak, the Company is in a very solid financial position. This means they can ride out this storm without having to raise money in a dilutive fashion while some of their peers may be forced to, or face bankruptcy. Simply put, Energold’s balance sheet allows them to patiently wait for the cycle to turn up again without resorting to any desperate measures, plus it gives them the option of buying assets/businesses very cheaply from cash-strapped competitors should they wish to.

Potential Outcomes When the Cycle Turns

Let’s cover the worst case scenario first. Energold’s stock could go to zero. Through a series of management blunders and a cycle that takes a super long time to turn up, the Company could go bankrupt. Although possible, I don’t believe it is realistic but I felt obligated to mention it because companies go out of business every day. Putting bankruptcy aside for now, let’s look at the prior two cycles and use Energold’s trough-peak experience as a guide.

Energold’s prior stock cycle hit its trough during the 2008 financial meltdown when the stock reached its low point of $0.53 per share in December 2008, which equated to a 90% decline from its prior high of $5.17 in May 2008. Yes, it fell 90% in seven months! The subsequent trough-to-peak run up to $5.64 in February 2012 lasted 3 years 9 months, equating to a total gain of 964% — almost a 10-bagger in under 4 years. However, the starting point of $0.53 is an extremely low stock price, and the ‘law of small numbers’ can make percentages changes on those tiny numbers misleading. Nevertheless, that’s what happened.

If we go a bit further back in time we can analyze the next oldest cycle. The trough for Energold’s stock in that cycle occurred in June 2007 at $0.75 per share. The subsequent trough-peak run up to $5.17 in May 2008 took one year, equating to a total gain of 589% — not too shabby in a year’s time. But let’s not get carried away with percentages here either, because the current trough (if I am right) occurred at a higher price point making subsequent percentage gains more difficult by comparison.

The current trough price is $1.36 hit a couple weeks ago on December 20, 2013 but we need to use today’s higher stock price of $1.51 as our starting point. I should mention that I don’t think the stock will fall below $1.36 due to its impressive balance sheet, where working capital acts as a soft floor. For our outlook I want to be more conservative than past experiences so I will assume that this time it will take 5 years to recover to the prior high of $5.64, equating to a total gain of 274% or $4.13 per share. [FYI, this would be a gain of 315% from the $1.36 trough.]

I think this is a reasonable expectation in terms of time-horizon and the $5.64 future price level. In fact, because of Energold’s recent expansion into providing oil/gas drilling services (not just mineral drilling which was the case in prior cycles) plus the possibility of using their strong balance sheet to make acquisitions at favorable prices, I think their stock will run past the previous $5.64 high point, but I don’t want to bake that into my model.

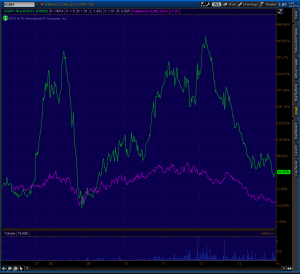

Here’s how Energold’s stock price has cycled over the past seven years…

Energold’s stock price (in green) vs. a basket of large mining companies’ (their customers) stock prices (in pink): same patternBut Energold’s stock offers a much more wild ride…

In my career, a lesson I have learned is that being late to a party is more dangerous and much less profitable than arriving early and waiting for the room to fill up. I cannot tell you how many times I have had ‘fallen angles’ in my sites (Corning at $1.80 in 2002 comes to mind) when they were in situations similar to Energold today, but I decided it would be prudent to wait for signs that business conditions were about to improve before investing, only to watch the stock rally BEFORE business improved in any meaningful way. Hopefully I won’t have to relearn that lesson again, and I hope you profit from my experience.

At the ideal moment to buy — the point of maximum pessimism — sound logic will betray you!

– Mark Schumacher

——–

Chris again.

Mark is a great thinker, an intelligent, careful investor, a valuable intellectual counterpart and friend. We’re grateful that he regularly contributes to our little corner of cyberspace!

– Chris

“Every Billionaire I know has been willing to take bets that were contrary to conventional wisdom at the time that were highly risky.” – Rick Rule