Market dislocations occur when financial markets, operating under stressful conditions, experience large widespread asset mispricing.

Welcome to this week’s edition of “World Out Of Whack” where every Wednesday we take time out of our day to laugh, poke fun at and present to you absurdity in global financial markets in all its glorious insanity.

While we enjoy a good laugh, the truth is that the first step to protecting ourselves from losses is to protect ourselves from ignorance. Think of the “World Out Of Whack” as your double thick armour plated side impact protection system in a financial world littered with drunk drivers.

Selfishly we also know that the biggest (and often the fastest) returns come from asymmetric market moves. But, in order to identify these moves we must first identify where they live.

Occasionally we find opportunities where we can buy (or sell) assets for mere cents on the dollar – because, after all, we are capitalists.

In this week’s edition of the WOW we’re covering Australian bank funding costs

My sister-in-law just bought a new cupboard apartment in Sydney. AU$1.4 million, the going price for an inmate of the city’s digs, gets you enough room for a cat, its litter tray, and a wine rack, which you’ll be emptying regularly in order to keep your sanity, living in confinement.

Sydney and indeed Australian real estate isn’t new to us. It wasn’t that long ago (6 months, actually) that I took a swipe at overvalued real estate around the globe. I suggested Vancouver was due for a good spanking and then discussed how Australia looked rather ugly, despite it’s pretty beaches, sunshine, and Kylie Minogue.

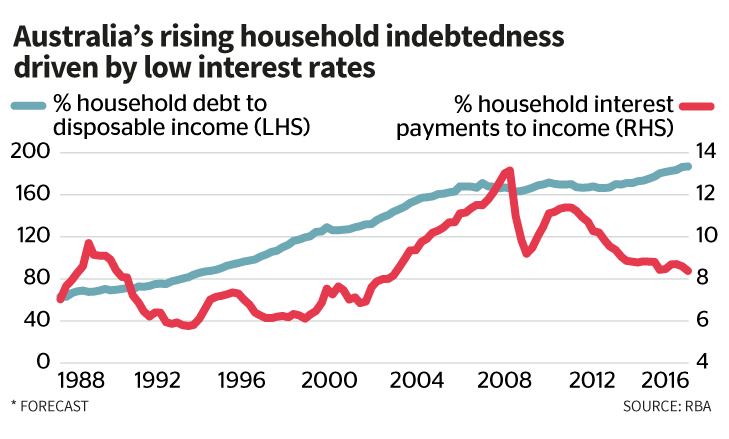

In order for any market to reach dizzying levels we need only look to the debt markets, because it is debt which provides the leverage behind most modern day bubbles. Aussie real estate is no different.

In an article discussing New Zealand real estate, I mentioned the following, and since it applies to Australia as well, it’s worth revisiting:

“What makes New Zealand particularly vulnerable is the fact that it has no domestic capital markets and as such borrows offshore. But offshore lenders don’t like currency risk which they’re taking as all lending takes place against NZD denominated assets.

Banks have to match the fixed rate mortgages against what is mostly floating rate borrowing. And since the NZ housing market is the largest single form of borrowing it is the biggest influencer on New Zealand swap rates.

Because most of the debt that NZ banks take on is floating, they pass this risk onto borrowers. And so it’s no surprise that the vast majority of NZ mortgage debt is either floating or fixed for no longer than 2 years at initiation. Offering anything longer means NZ banks would be taking on risk they simply can’t hedge economically.”

Fast forward to just yesterday and the Sydney Morning Herald just published an article:

![]()

The article goes on to say:

“Big banks are predicted to raise variable interest rates this year in response to a squeeze on profits from higher funding costs.”

Another gem worth noting is this.

“After several smaller banks hiked variable rates over summer, NAB also said it was grappling with the higher cost of funding variable rate loans, used by the majority of borrowers.”

Variable rate loans have looked very attractive to borrowers for two reasons.

- Fixed rates have kept falling, and falling, and falling, creating a complacency that this is indeed just what happens. Imagine locking yourself into a fixed rate only to wake up a month or two later to find it lower – an uncomfortable experience. And so it’s no surprise that when the reward for prudence is punishment, actors change their behaviours.

- They offer flexibility to pay off loans in lump sums, and there are typically no break fees on the mortgages.

Now let’s revisit my article again:

“Any sudden rise in the cost of offshore borrowing can have a disproportionate effect on mortgage rates and the debt payments Joe Sixpack is making. Joe remains completely unhedged against interest rate risk. And there is precious little he can do about it unless he’s sophisticated enough to hedge his mortgage risk in the futures market – something I assure you is as likely as my following Justin Bieber on Twitter.

Simple volatility in the currency can cause risk premiums to rise as offshore lenders hedge this volatility risk but most Kiwis don’t seem to understand this risk. And that is at a time when the Kiwi dollar is under pressure due to the USD bull market, coupled with falling commodity prices, dairy in particular.”

According to the Sydney Morning Herald, only 15% of borrowers have fixed rate mortgages. Put another way, fully 85% of the mortgage market is sitting on variable rate mortgages. I’m sure it’ll be fine.

Recap

So the vast majority of folks are sitting on variable rate mortgages right as the global funding markets begin a sustained capital drive back to the US, causing funding liquidity to further constrict and costs to rise as a global shortage of capital makes itself felt in the commercial funding markets. Whoah, nice one!

If you want a better understanding of how the global funding markets are functioning (or should I say not functioning), I strongly suggest going back and reading or re-reading my articles on eurodollars. The first part deals with the eurodollar market, the second part with why the Eurodollar market is not functioning properly, and in the third part, entitled Collateral Damage, I discussed the underlying reasons for the breakdown in the global funding markets, of which the Eurodollar market is the big daddy.

National Australia banks COO had this to say of the funding markets:

“That is something we are continuing to see, and it’s something we’re still grappling with in working through how we reflect that longer term in terms of competitive positioning and pricing, etc.”

I’ll translate that for you. We’re soiling ourselves here because we’re completely unprepared for a turn in the bond market and subsequent rising funding costs. We haven’t figured this out but it does look worrying.

How long until we find the major Australian banks failing to meet common equity tier 1 capital requirements, resulting in them going to the market to raise capital (issuing shares)? We’re probably going to find out in 2017.

The repercussions of decades of foolish monetary policy have created asset bubbles in multiple asset classes, while at the same time having starved other sectors of capital, thereby creating extraordinary asymmetry. Just what we’re focussed on here. Lucky us!

For this week’s World Out of Whack I ask the following question:

If I’m wrong and option 4 is indeed correct, I have a cunning plan for that scenario.

You see, if I’m wrong and prices just keep rising, people will live in smaller and smaller shoeboxes, and I’m going to go long hamsters. There won’t be space for fluffy the cat anymore, and instead we’ll see a boom in hamster sales with a deluge of cats and handbag dogs finding their way onto the streets and to the pound.

On the plus side we’ll see menu prices at Korean restaurants halve as cat supply hits the market. So there you have it. Long Korean restaurants and hamster sales.

– Chris

“We need to be thinking now about how to deal with higher interest rates down the track. We can’t just say it will be fine because it won’t be.” — Martin North, Principal of Digital Finance Analytics