When Michael Burry saw the impending housing crisis looming large, he went out and bought credit default swaps on subprime mortgages.

What did he know that the broad market didn’t?

He knew the structure of the housing market better than most because he did the homework. He dug through the numbers and looked at the mortgages that formed the different tranches. In short, he knew it as if he’d built the entire pile of isht himself. He knew it was rotten and it was only a matter of time before it all collapsed, and THAT is why he had the conviction to buy CDSs like they were the last bottles of water in the middle of the Sahara.

Fast forward to today, and tell me what’s more screwed up than those mortgage-backed securities and credit default swaps the bankers put together pre-GFC?

I’ll tell you what. Global central bank interventions, and the various insane monetary policies enacted in the last decade, which have blown central bank balance sheets up like some giant malignant tumour, that’s what.

The Fox Smells His Own Hole

The folks who’ve been at the helm of these central bank ships, the ones who put all this together — we could say they’re lunatics, but they’re lunatics who still realise they’re playing with fire.

And when you’re playing with fire, it’s only reasonable you stack a few fire extinguishers in the cupboard.

What fire extinguishers are those?

Way back we predicted the current global trade wars gracing your news channels today.

Next? Currency wars. Watch!

And this is when gold gets really interesting, because it is when faith in currency comes into question that gold really benefits.

Who’s Buying?

Let’s start with who isn’t. Retail investors aren’t.

Maybe this’ll change if Elon Musk starts tweeting about launching a gold company and Justin Bieber starts posting pictures on Instagram with gold bars, but that hasn’t happened yet.

Earlier this year the World Gold Council published its quarterly report, which shows us exactly who has been buying.

And it shows that central banks and foreign governments from around the world are buying up gold at their fastest pace in six years.

Net gold purchases in Q1/2019 among foreign governments and central banks was nearly 70% greater than Q1/2018… and the highest rate of first quarter purchases in six years.”

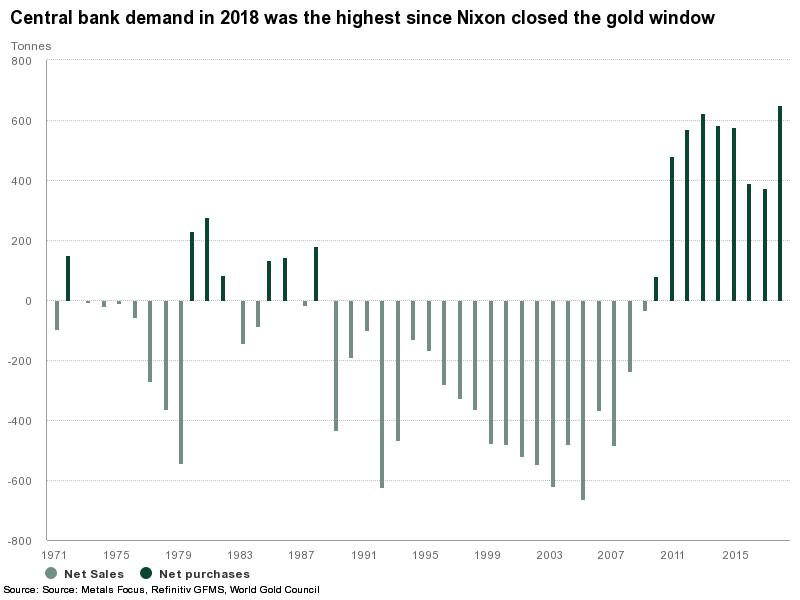

Central bank net purchases reached 651.5t in 2018, 74% higher y-o-y. This is the highest level of annual net purchases since the suspension of dollar convertibility into gold in 1971, and the second highest annual total on record. These institutions now hold nearly 34,000t of gold.

Heightened geopolitical and economic uncertainty throughout the year increasingly drove central banks to diversify their reserves and re-focus their attention on the principal objective of investing in safe and liquid assets.

Our Chinese friends in particular have been stockpiling gold faster than Charlie Sheen snorts lines of coke on a weekend bender.

But it’s not just the Chinese. This is a global phenomenon amongst governments now.

Importantly, the selling of gold by central banks is now so yesterday.

Net purchases again dwarf net sales. And while net purchases have been eye-catching, net sales remained minuscule throughout the year. Australia (4.1t), Germany (3.9t), Sri Lanka (2.4t), Indonesia (2t) and Ukraine (1.2t) were the most notable net sellers. Overall, net sales totalled a paltry 15.6t. This serves as a reminder that recent central bank demand is supported by a combination of high purchases and low sales.

You may recall that period in the mid-2000’s when central banks were dumping gold faster than a steak sandwich at a vegan festival.

But post the GFC, right when they collectively sat down and said, “Yes, let’s do this, all of us together otherwise it won’t work, let’s go full retard,” right then, they began buying gold.

And not just in eensy-weensy little “oh, we’ll nibble on one of those little McDonald’s cheeseburgers” fashion.

No, they went straight to the biggest baddest joint in town and promptly said, “We’re ordering the triple cheese heart attack burger and we’ll take all you’ve got.” Which makes sense if you think about it.

Stop and think about what the SNB, the ECB, or the BOJ have done when it comes to monetizing their balance sheets over the past decade. It’s not trite to say it’s been unprecedented.

Think about it like this.

If you were some crazy scientist who’d just developed Ebola with a plan to unleash it on the world, what would you do? I know what I’d do. I’d get myself a bloody antidote to ensure I can survive the apocalypse. I’d prepare for near death. And it looks to me like that’s exactly what the central banks have been doing.

And yet here’s gold in USD.

It’s been stuck in a trading range for 6 years or so, frustrating the gold bugs and encouraging the gold bears to laugh, point fingers, and make faces showing how crappy gold has performed relative to growth stocks such as the FANGS.

Speaking of the FANGs…

And while the FANGs have soared and outperformed gold handily, it’s not like gold has done badly. In fact, it’s just trucked along with retail investors becoming increasingly disinterested selling into the central bank buying.

Zooming into that gold chart, you’ll notice the recent breakout from its 6 year trading range. Mmmm…

So where does that leave us?

Well, the central banks have built something far, far worse than the almighty mess that Goldman and co built going into the GFC. And now they’ve spent the last 6 years loading up on gold.

The distrust between governments is palpable. And together with the monstrosity they’ve all built and the realisation that what they’ve built can’t easily be undone, it should be no surprise that they are rapidly preparing for survival. Perhaps you should too?

That the broad market hasn’t noticed is a gift. So while they’re focussed on Tesla’s latest production numbers, Trump’s latest tweets, and Kim Kardashian’s posterior it may be wise to use this period of relative quiet to do what very few are doing.

And on that note, it would be remiss of me to fail to give you the opportunity to let you know exactly how we are taking advantage of this.

I don’t say this sort of thing often… or ever actually, but I believe the timing is as close to perfect as we may get to invest in a sector that should absolutely form a portion of every sane investor’s portfolio.

And while we can (and do) position accordingly in our fund and research service, we have arguably the most leveraged means of making a killing in this sector together with our resident resource expert Jamie Keech, where we’re about to invest alongside THE VERY BEST in the industry and on terms that we believe a few years hence will be looked upon with the sort of envy that folks look at Burry and his housing short.

If you’re an accredited investor who sees the world in a similar light to us then I encourage you to go here and register for more information.

Oh, and you know what Michael Burry is purportedly investing in these days?

Water, agriculture, and yes, gold.

-Chris