Happy March RI members! It has been a busy and, at times, exhausting month. For me much of the last few weeks has been spent on an airplane.

As I write this, I’m sitting on a flight heading to NYC from Sao Paulo, Brazil after spending the last week and a half traipsing around the Amazon.

I’ve somehow managed to take 7 flights and visit 6 different cities in the last 5 days. After a few meetings in New York, I’ll be heading back to Vancouver for a few days and then it’s off to Toronto for the Prospectors and Developers Association of Canada’s (PDAC) annual conference, the world’s largest and most important mining show.

I spend a lot of time thinking about the best ways to find and get access to great deals in the mining sector, for both myself and our members. I focus on growing my network of high achievers in the space, constantly reaching out to new and successful teams, and systematically tracking high potential regions and projects – this has served us well to date.

But, part of my personal philosophy is that to access truly great deals (on the ground floor) sometimes you have to create them.

Over the past several years I’ve spent a considerable amount of time, energy, and my personal capital incubating what I believe to be high potential projects around the globe.

One of these is a high-grade historic gold mine in Brazil. A company, which I co-founded 2-years ago and currently act as an advisor to, is in the process of a corporate restructuring which should enable exclusive access to one of the most fabled and (potentially) valuable precious metals projects on the planet. It’s a true asymmetric opportunity. High risk? Yes. But with a controlled downside and staggering upside potential.

It’s a deal that I hope, one day, we will be able to feature in the pages of Resource Insider.

There is still a lot to accomplish and de-risk before we reach that point. But that’s OK, because it’s just one opportunity.

At any given time, there are 3 to 4 projects that I’m working to incubate with various partners around the globe; from early stage exploration plays in Eastern Europe, land grabs in the US, and mine re-development projects in Latin America. Most of these will hit insurmountable road blocks or not stand up to my due diligence process and will thus be killed long before being introduced to outside investors.

But the key here is the process. As with all asymmetric opportunities, we only need one to work to see outsized returns. If we patiently and diligently work the process, we’ll get results.

It’s also one of the ways I’m working to set RI apart from ALL other newsletters and so-called research services. My goal is to provide our members with an inside view into the creation of new deals and earlier access than can be found anywhere else.

What’s New

Disaster Strikes

Part of my reason for visiting Brazil this week is due to the tragic news of yet another tailings damn spill. This time at Vale’s Corrego do Feijao mine, whose failure resulted in the death of over 300 people, only 4 years after the 2015 Samarco spill that killed 19.

This disaster is bad for Brazil and the Brazilan people, awful for Vale, and horrible for the mining industry as a whole. I spent much of the week meeting with senior officials in Brazil’s mining ministry, communities, and other stakeholders trying to wrap my head around the implications of the incident. The immediate repercussions for mining in Brazil are severe and will likely place significant financial burdens on the companies operating in the country. There will also be major implications for the industry as a whole affecting the way tailings damns are constructed, monitored, and maintained.

It’s extremely disappointing to see this happen yet again, and one can only hope it acts as a wakeup call for companies to start taking the responsibilities associated with these structures more seriously. Everyone knows mining is a risky business… but death should never be on the table.

It’s Show Time, Folks

What mining conference has had a man shot dead in the lobby of one of Toronto’s busiest hotels? The PDAC.

Where have I seen a 45-year-old woman get arrested for kicking empty beer bottles down the fire-escape of that very same hotel? The PDAC.

It’s like Christmas, New Year’s Eve, and a drunken brawl in a Thai whorehouse all rolled into one. That special time of year when every mining executive, banker, prospector, and degenerate associated with the industry meet up to do deals, drink too much and (when not haunting the strip clubs of Toronto) attempt to scrape together enough cash for the upcoming fields season.

Each year I look forward to this conference with a unique mixture of anticipation and dread. It’s always a fun reunion with old friends, university buddies, and far flung collogues. With a bit of preparation, it is the best place to meet new companies, get the inside scoop from foreign mining ministers and dignitaries, and gain a feel for what to expect over the coming year.

My schedule is already packed with a series of meetings, drinks, dinners and interviews. My primary goal (as always) is to find high-calibre deals. To that end, I’ll be meeting with dozens of CEOs and financiers to sort through the nonsense, scams, and the pump & dumps to identify the best opportunities coming down the pipeline this year.

I’ll be keeping a particularly keen eye out for high value copper opportunities, which I’d like to add to our portfolio shortly. I’ll also be learning more about what’s going in the Tethyan belt (primarily in eastern Europe) and East Africa (Ethiopia, Eritrea, Sudan). My hunch is that this is where the greatest discovery opportunities lie in the coming years.

Eat or Be Eaten

It has been the year of mega mergers in the gold space. With the major mining companies seemingly intent on consuming one another at an astonishing rate. Last week Barrick Gold announced a hostile bid to take-over Newmont in a $17.8B all-share deal (an 8% discount to Newmont’s current share price). If successful, this would create a golden-juggernaut with a $42B market cap and dwarf its closest competitor, Newcrest at (~14$B).

The proposed takeover is on the heels of Barrick’s recent $18.3B merger with Randgold last year, after which Randgold CEO & Founder Mark Bristow took the reins of Barrick vowing to optimize and streamline the company.

Add to the mix the fact that Newmont is currently in the throes of a $10B transaction to acquire Goldcorp, and we’re clearly in one of the most exciting M&A environments to hit the mining market in years.

It’s hard to say exactly what game Barrick is playing here. This could be a legitimate play for Newmont, or it could simply be a ploy to throw a spanner in the works of Newmont’s Goldcorp acquisition. My gut feeling is that it is unlikely to succeed if Barrick’s best offer remains at a discount to Newmont’s current share price. Mr. Bristow pontificates grandly around the “$7B of synergies” that his proposed merger will unlock, but it’s hard to think that Newmont shareholders are going to swallow that pill easily.

That said… it is somewhat more complex than that.

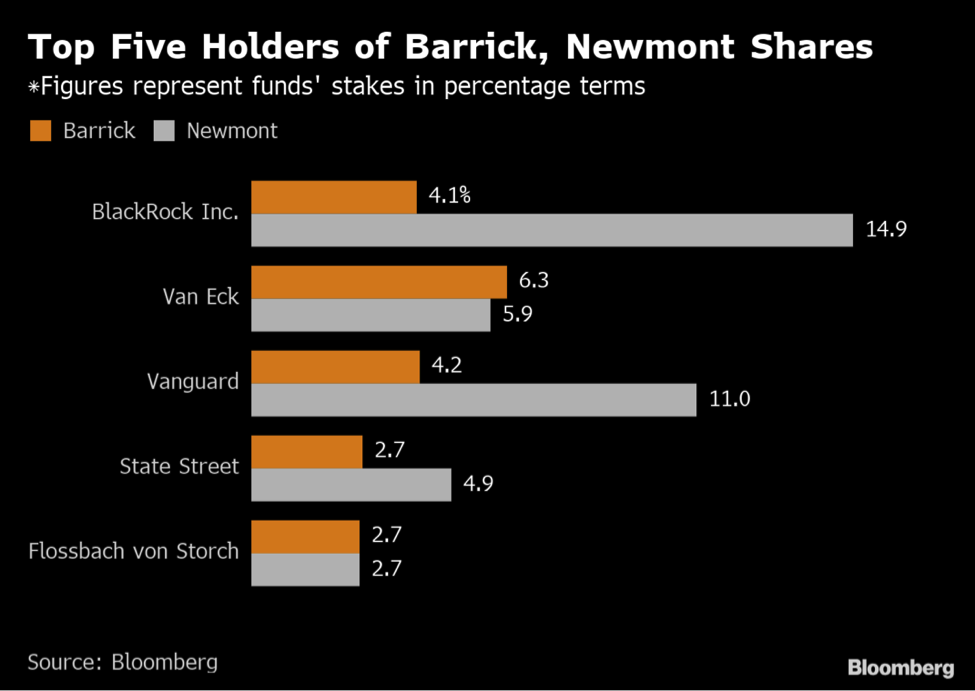

Newmont’s biggest shareholders also happen to be Barrick’s biggest shareholders. With the top five holding 55% of Barrick and a whopping 91% of Newmont. If Bristow can sell them on the synergy angel and convince them he’s the best man to chart the course, I’d say its game over for Newmont.

To be honest I’m on the fence as to what I’d like to see happen here. I love that both of these companies are being run by dyed in the wool, boots on the ground miners, as opposed to accountants/lawyers/bankers (no offense) and it makes for exciting times in the industry to see them face off. The patriot in me would love to see a Super-Mega Miner ($42B!!!) based out of Toronto, Canada. On the other hand, it’s hard to fathom the effect that level of consolidation would have on the industry.

I doubt the deal goes through at the current offer, and Barrick claims they are definitely not upping the price. But at this point it’s all smoke and mirrors, and we’ll have to just wait and see. Regardless, after a rather dull 8 years in the mining space, this level of M&A is both exciting and promising. I suspect that this is just the early rumbles of what will be accelerating activity across the sector in the coming years.

Portfolio Review

Progress Minerals

There is nothing significant to mention pertaining to Progress this month. They are still in the processes of regrouping after the recent tragedy. I know they are planning to begin work on the Cote d’Ivoire projects as soon as reasonably possible, and I’d estimate that to be in the next 3-4 months. I’ll be sitting down with CEO Adam Spencer to Toronto this week to learn more.

Resource Insider Uranium Fund SPV

No new deals in the RI Uranium Fund in February, however I’m working on one with Mike as we speak, which I anticipate will be completed late next week. This one is small financing and quite exclusive, so I’m excited to share it with you next month when all is complete.

By now you should have received access to all necessary documentation associated with the transaction from Assure and you will continue to receive updates as required (if you have not, please let us know).

This month you will also start receiving regular updates from us summarizing Sachem Coves Performance. There was a slight snag in how these would be distributed, but it has been sorted out and you will now receive the relevant info from me each month.

As previously mentioned, Mike and I will be heading down to Peru together in mid-April to evaluate an interesting uranium asset. I’ll be providing updates on this as we proceed.

I’ve promised a Q&A video with Mike, and I must apologise for the delay. We simply couldn’t align our schedules last month. But we plan on getting it down this month, so I’d like to encourage everyone to send through any questions you might have, and I’ll be sure they get covered.

Northern Vertex

At long last NEE has closed the first tranche of its $2.6M financing, for a total of $2.0M. The delay was due to NEE waiting on a large investor to round up the funds required to participate. This was completed February 21st, and the second and final tranche ($0.6M) is expected to close shortly.

Things are cracking away on site at Moss, and the team continues to optimize the operation. They’ve finally drilled a proper well on site, which has eliminated the need to truck in water (~$300k/month savings) and they’ve continued to grow the operations team. In fact, I recently bumped into Maverix Metals VP Tech Services, who had spent the previous week on site at Moss, and he reported that he was very pleased with the progress being made.

On an irritating note (brought to my attention by one of our observant members), the NEE board has decided to issue themselves 10M options at $0.24 (the current share price). Which proceeded to dilute us shareholders by ~4%. In my view it is largely unacceptable to issues oneself options at the current share price. Options are meant to be an incentivising instrument… not a pat on the back.

I plan on digging into this at the conference this week. NEE has done a fantastic job the last several months and management has put the company on track for major long-term success. I assume these options are to position and incentivize new board members, however I would not wish to see this sort of dilutive action occurring on a regular basis.

It’s Mostly the Shots you Don’t Take

This week one of our members reached out to me regarding a deal that he came across. This deal looks awesome. It’s new, it’s exciting, its run be an impressive sounding team and a high-flying chairman. He was right to flag it and suggest it for a potential private placement opportunity.

The problem with this deal is that it is backed by a group of promoters with a long and storied track record of running extremely shitty, and usually short-lived, pump and dumps. Occasionally they’ll hit on a winner, but the majority are characterized by a steep rise, and shortly thereafter an even steeper fall.

This same deal came across my desk (while it was still private) several months ago. We were offered the “opportunity” to participate in the company’s IPO round. On the surface it looks great, and if I hadn’t known the players involved, and the fact that they received their stock at a fraction of the price I was being offered, I would have been tempted to participate. But I chose to pass.

Hopefully I’m wrong. I hope the company is a massive success. Great for shareholders and good for the industry at large. But I like to play the odds.

At Resource Insider we focus on great teams, with consistent reliable track records. And, unless you know the people personally it is difficult to discern between a great company and a great story.

We won’t always get it right, but I make sure the people I invest in will definitely be working towards our interests.

What We Are Looking At

The list is largely the same as last month. We’re still actively engaging with management and completing our due diligence. I plan on working to eliminate a few of these and add to the list at the PDAC this year.

Rio2 (TSXV: RIO) — Love this project. Love the team. CEO Alex Black is a mining engineer and career mine builder who had a serious success with Rio Alto in Peru several years ago. He’s now working to repeat that success on a similar gold project in Chile with Rio2 (get it?). I actually bought this stock on the market at ~$0.60 last year and despite the fact that the current financing is much cheaper than that ($0.45 with a warrant), and I’m still glad that I own it. My biggest concern is that the Fenix Gold project is probably ~5 years from production, and this part of the mining life cycle is a very difficult time for any company. They will definitely be back to the market next year for more money and given where they are on the development curve and where we are in the cycle, I’m not convinced they will be trading higher than they are today. That said I know many great investors excited about this deal… I’ll be considering carefully over the next week.

Plateau Energy Metals (TSXV: PLU) — Same as last month. Interesting lithium and uranium assets in Peru. Very good management team whom I know well. I’ve been talking extensively with management and like the project more and more, plus it is cheap right now. With the right deal (ie. warrants!) this could be a very good buy. Working to better understand how the lithium is hosted, the extraction process, and permitting risk in Peru.

Solaris Copper (Unlisted) — Massive copper project in Ecuador. I love this project and believe it has the potentially to be a massive discovery. Solaris is currently a private company controlled by Equinox Gold (where I used to work). Solaris is expected to IPO and will likely need to complete a financing, but a date has yet to be set. At the right price this undoubtedly one of the most interesting copper stories on the planet right now, and one I’m watching very closely and angling to get us involved in.

Sun Peak Metals (Unlisted) — I am already a tiny (~$2,500) shareholder in this Ethiopian exploration company and would very happily increase my allocation. East Africa is truly one of the last great frontiers for exploration. Massively under explored, when compared to West Africa, it holds tremendous discovery potential. Sun Peak is led by a team that I respect, explorers who know the area extremely well having cut their teeth for years next door in Eritrea, and making two discoveries at Sunridge and Nevsun. Exciting project lead by guys that know their stuff.

Pucara Resources (Unlisted) — Gold. Peru. Potential for a massive discovery. I’ve just started to look at this one, but I’m interested in two reasons: 1) Marcel de Groot is one of the major investors, and 2) my friend, Keith Laskowski, is on the board. Keith is one of the best geologists I’ve ever met. He’s highly critical and a born skeptic. For him to put his name on something makes me sit up and take it very seriously.

What We Passed On

Pass might not be the right term for these two, but certainly delay for the foreseeable future.

Warrior Gold (TSXV: WARGF) — Very interesting land package next to one of the most prolific gold camps of all time: Kirkland Lake. Located in northern Ontario, Canada and hosted in a greenstone belt (similar geology to Progress). Led by a very experienced geologist who managed to cobble together numerous claims over several years into what is now a respectable land package. However, it was simply too early. No drill holes and very little information – it would have felt too much like gambling. I’m content to wait until the next round and pay a slight premium if they hit something.

Talon Metals (TSX: TLO) — Still love the asset, but I decided to wait. I’m not convinced this financing is the best entry point. I suspect Talon will be back to the market for another raise in the next 18-months, and I’m not convinced it will be at a premium. I’d rather wait and see.

Adios!

BONUS: Meet Nick!

Running Resource Insider is a lot of work, and I don’t do it all alone. An important member of my team is our research analyst, Nick D’Onofrio. Nick is a grad student at the Colorado School of Mines, and he has been working with me the past few months conducting research and evaluating opportunities. He’s been filling an ever-greater role here at RI headquarters, and I think it’s about time I introduced him to our members.

Below is a short article that Nick wrote on the gold space. Please enjoy!

GOLD, Frankincense, & Myrrh

After the holiday season I was contemplating Biblical scripture, though perhaps not in a traditional sense. Instead, I began thinking about it from an anthropological perspective.

When we think about the birth of Jesus, the focus is the manger, three wise men, Joseph and Mary, and King Herod. The three magi are famous for the gifts that they brought Jesus, gifts fit for a king – gold, frankincense, and myrrh. These were standard gifts to offer a king during the time period: gold as a precious metal, frankincense as incense or perfume, and myrrh as anointing oil. Gold was a symbol of kingship and material value, frankincense a symbol of spirituality (many kings were regarded as gods), and myrrh to prefigure death and embalming. These symbols were not limited to the Jews or the region, there are accounts of similar offerings to Apollo, and even more glaring examples in Egyptian society.

Unlike frankincense and myrrh, gold has managed to hold its value throughout the eons.

It is useful for properties such as corrosion resistance, malleability, ductility, and conductivity. Despite limited practical uses, gold seems to play into our collective psyche. It is aesthetically pleasing, hence its use in jewelry, and relatively rare. To put this scarcity in perspective, total gold mined throughout history would not fill a 25-meter squared box.

Financially gold is a fascinating asset. It allures many investors through the promise of independence from the financial system, universal liquidity and long track record of maintaining purchasing power with minimal counterparty risk. Gold’s independence from the financial system stems from the USA officially leaving the gold standard under the Nixon administration in 1971, to halt foreigners from drawing down US gold reserves. The US dollar maintained its place as the global reserve currency, thus leaving the Federal Reserve Bank in charge of USD supply and demand metrics. When this occurred, it fully detached gold from the financial system leaving it as a hard asset to be traded purely on supply and demand.

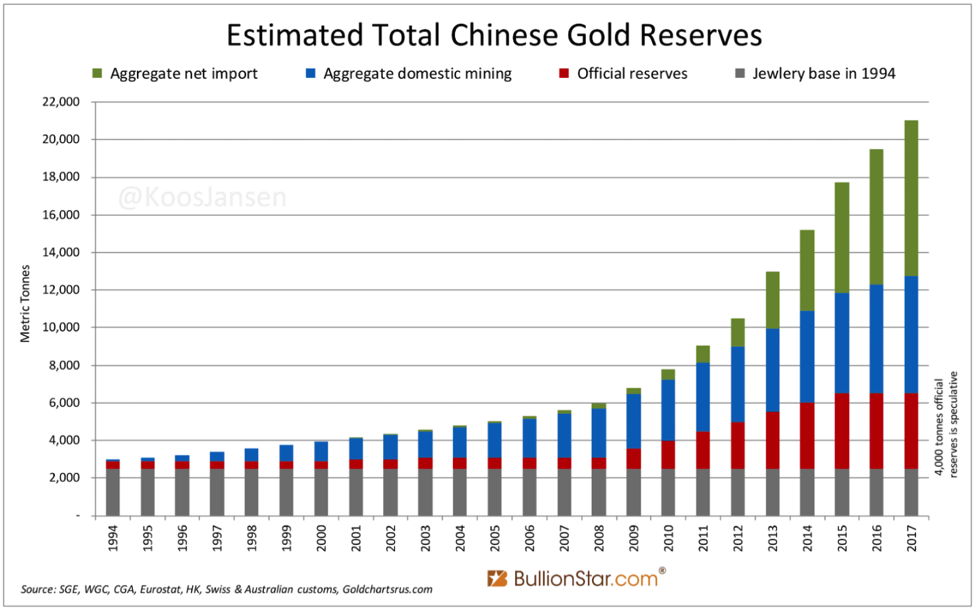

However, this does not mean that gold is exempt from manipulation. Central banks the world over have been increasing their gold holdings. In particular, China has been maniacally focused on acquiring the yellow metal over the past decade. One can speculate as to why, but inevitably we’ll have to wait and see.

Gold Has Universal Liquidity

As one of our oldest forms of currency, we’ve managed to consistently maintain our taste for the metal over the past 2,500 years. When the geopolitics of the world shift, we can always count on our fellow humans to desire the precious yellow metal. The price you’ll receive for an ounce of gold may fluctuate, but I would bet that we never see the value of gold take a nosedive similar to a fiat currency experiencing hyperinflation.

What do you think your average Venezuelan’s view on fiat currencies versus gold is at the moment? I suspect it takes considerably fewer wheelbarrows to buy a loaf of bread in gold rather than Venezuelan pesos at the moment…

Gold Is a Store of Value

You may be thinking that since you live in a developed country, with a reliable fiat currency such as the USD, you have no need for a store of value such as gold. Fantastic, you are a part of the lucky few in the world… Right? But perhaps, we should take a look at how the Fed has been eating away the buying power of US citizens for the last 34 years.

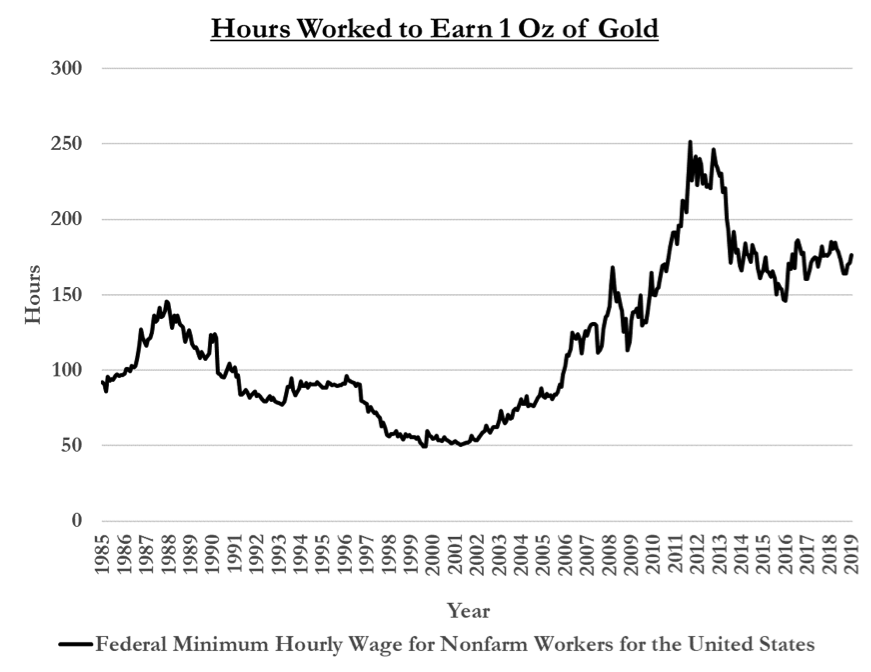

Yes, the chart is for minimum wage employees and few reading this will be in the same tax bracket, but the graph remains consistent for total average wages. Compare today to 2000, and you have to work three times as much to buy 1 oz. of gold, and suspect many have not seen their salary triple during this time period.

Virtually No Counterparty Risk

Counterparty risk is risk associated with another party not upholding their end of a deal. As an example, say you made a bet with a friend while not fully understanding their financial health and obligations. You win the bet, but your friend had made the same bet with another person and paid them out first. Now he doesn’t have the money to pay you in full. While you won the bet, you did not receive full payment because there was a counterparty risk you didn’t fully comprehend.

I say virtually no risk because many choose to purchase gold through ETFs or store the metal with a third party, which in the event of global chaos may leave you unable to access your assets. This type of investor is largely buying gold for financial exposure. Many could (and do) argue that in this sense, investing in mining companies is a better option. Mining companies tend to offer considerably more upside exposure to price moves within a commodity. They can also usually offer some protection to commodity price swings, but to reap this benefit you must be invested with the right companies and projects. While the price of gold may drop considerably, a great mining company may (and should!) have low cash costs and still be turning a profit. On the other hand, if it is an inferior operation with high operating costs, then it may lose value to an even greater degree than physical gold.

This is where adequate due diligence can make or break an investment portfolio. Gold is more than a useful commodity, such as oil or copper. It is its own beast, surrounded by a unique history, drama, and greed. Having held its role as a store of value for more than 2,500 years the yellow metal can, and should, hold a place in every investor’s portfolio. It may well be the one thing that can support global trade in a world of central bank manipulation, fiat currencies, and rising of populism.

Unauthorized Disclosure Prohibited

The information provided in this publication is private, privileged, and confidential information, licensed for your sole individual use as a subscriber. Capitalist Exploits and Resource Insider reserves all rights to the content of this publication and related materials. Forwarding, copying, disseminating, or distributing this report in whole or in part, including substantial quotation of any portion of the publication or any release of specific investment recommendations, is strictly prohibited.

Participation in such activity is grounds for immediate termination of all subscriptions of registered subscribers deemed to be involved at Capitalist Exploits. Capitalist Exploits reserves the right to monitor the use of this publication without disclosure by any electronic means it deems necessary and may change those means without notice at any time. If you have received this publication and are not the intended subscriber, please contact admin@capitalistexploits.at.

Disclaimers

Capitalist Exploits website, World Out Of Whack, Insider, Resource Insider and any content published by Capitalist Exploits is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The information contained in such publications is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. The information in such publications may become outdated and there is no obligation to update any such information. You are advised to discuss with your financial advisers your investment options and whether any investment is suitable for your specific needs prior to making any investments.

Capitalist Exploits and other entities in which it has an interest, employees, officers, family, and associates may from time to time have positions in the securities or commodities covered in publications or the website. Corporate policies are in effect that attempt to avoid potential conflicts of interest and resolve conflicts of interest should they arise, in a timely fashion.

© Copyright 2019 by Capitalist Exploits