Greetings Resource Insider (RI) members, and welcome to the first of what will now be regular RI monthly reports. The purpose of this is threefold:

- Provide you with regular updates on the RI portfolio companies including details on what they’re up to, how we interpret results/progress/delays/etc, and how we’re managing our holdings.

- Keep you up to speed on what we’ve been working on. It may sometimes feel like you haven’t heard from us in a while, but, rest assured, there is always a lot going on here behind the scenes. I’ll be keeping you up to date on the deals I’ve reviewed (and why we passed on them), the people I’ve been talking to, and what’s going on in the industry in general.

- Let you know what’s next. I’ll discussion what we are focusing on and why. We want to keep our members up to date on the projects that we are looking at and in the loop on what is coming down the pipeline over the coming months.

What’s New

It’s been just over 4 months since we launched RI and we have been very busy. RI has completed two great deals, reviewed many more, and we currently have 2 new opportunities under review (more on that later).

The priorities for November 2018 were twofold: close the Sachem Cove deal and review new deals to find the next opportunity for RI members.

After a significant amount of work and several beneficial changes to the original structure, the Sachem deal was closed November 30th, 2018. This took ~2 weeks longer than previously anticipated, but, upon conclusion, we are very happy with the results.

The Market

The Toronto Venture Exchange (TSXV) is getting absolutely crushed. The TSXV is where most of the opportunities that I review (and most mining deals in general) are listed.

In fact, it’s been the worst year since 2015.

If your broker hasn’t jumped off his balcony yet, it’s probably crossed his mind.

Keep in mind that this is not purely reflective of the mining sector. The TSXV contains many of the imploding blockchain/crypto-bullshit companies, as well as cannabis companies that are starting to unravel post legalization here in Canada.

In short, when it comes to the venture world, there is blood in the streets.

The Miners

It has been a hard year for the mining industry. Gold companies have seen a meaningful drop in value across the sector:

So much so, that when I talk to gold CEOs around town, I continually hear things such as: “we’ve only dropped by 10%, we’re out performing our peers!”

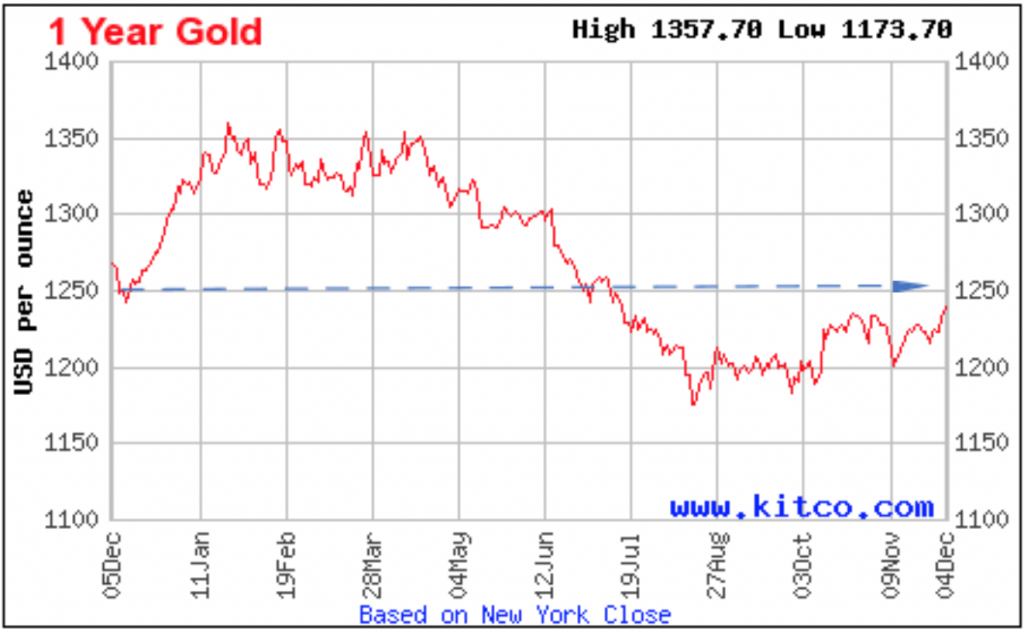

After a good start, physical gold has more or less traded sideways all year:

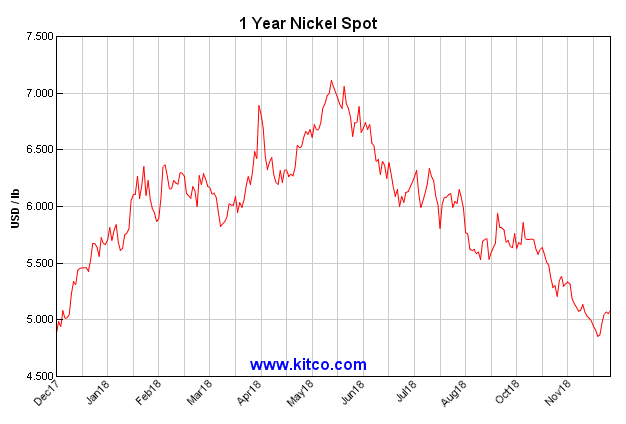

Nickel has been hammered after a promising run:

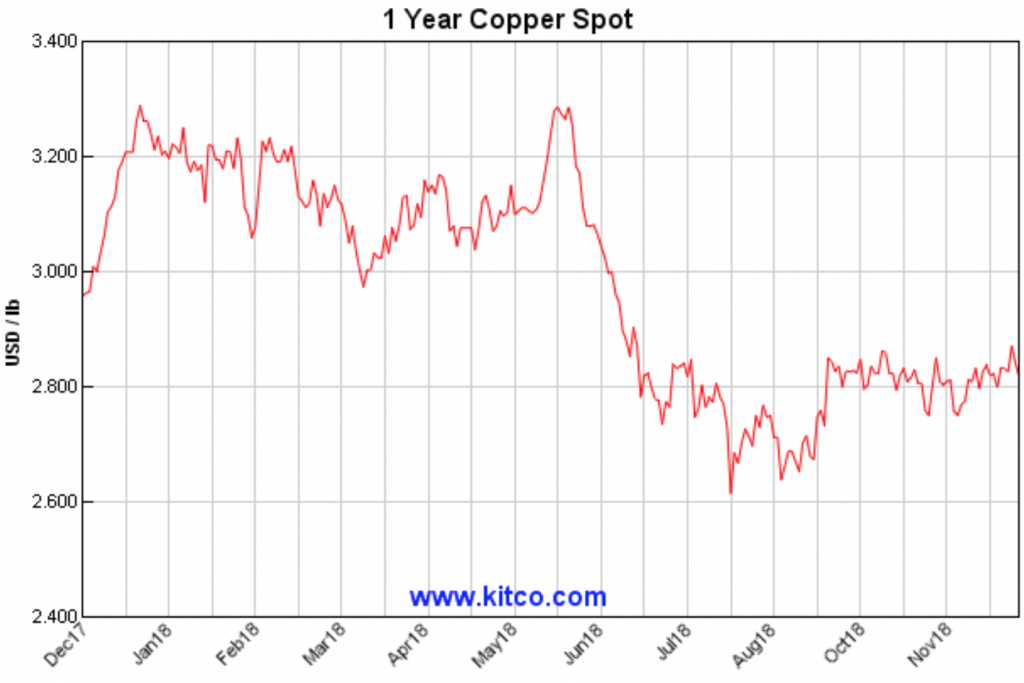

Copper has had a particularly uninspiring year, despite a very modest rebound in the past few weeks when everyone woke up and realized that hardly any of the world’s producers could break even at ~$2.60 a pound:

In short, 2018 has been a truly dismal time to be a resource investor. Unless, of course, you’re a Resource Insider member.

It’s not a coincidence that we launched this service when we did, in mid-2018. We saw the market bottoming and wanted to be in position to take advantage of it.

Any halfwit can mouth the words “buy low, sell high”. But, as RI and Insider members well know, very few people are able to muster the fortitude to break free of the collective inertia and accomplish this task.

Most mining-focused newsletters on the market acquired their subscribers in the mini-gold bull market of 2015/16. They then proceeded to push them into variety of stocks at the top of that market. It’s also why most of them are hemorrhaging angry subscribers at the moment.

Fortunately, we are not a newsletter but a research service deploying our own capital. That is why it is not a coincidence that we have spent the past 4 months focused on deals that are not only private but will remain so for the medium (Progress) to long term (Sachem). We have specifically chosen unlisted investments because the market has been so punishing. Nearly every mining company that’s gone public in the last year is down; irrespective of quality.

The market is giving little value for positive exploration results and it has become nearly impossible for exploration companies and developers to raise capital.

It costs hundreds of thousands of dollars a year in legal, regulatory, and accounting fees for a company to remain listed… and right now those expenses are adding very little value to public mining/exploration companies. Refinancing these companies at a depressed share price will be extremely dilutive to early investors. Even if they do manage to succeed down the road, the result is a severely capped upside for investors.

There are many great companies out there that are well and truly screwed at the moment. They are unable to advance their project or raise capital and are basically treading water in limbo, hoping to keep above the surface until capital flows back into the space.

And, I could not possibly be happier about this situation! Right now, these poor bastards are so desperate for cash that they’d sell their oldest child for one more drill hole. For those of us that have had the good sense to wait until this moment (read: RI members), opportunity awaits. It means:

- Discounted stock in private placements;

- Aggressive long-term warrants;

- Investors have the opportunity to piggyback on the hundreds of millions of dollars of work done to date, currently getting zero value in the market, for free; and

- We get to come in and extract deals from companies that are better than their founders got.

And that, dear reader, is why we started Resource Insider. This exact moment.

Now, you may be asking yourself, if capital markets have been hit so hard over the past year, do we actually know that we are at the bottom?

The answer is no. I don’t and neither does anybody else. But, with depressed metal prices squeezing operators and disincentivizing new project from coming online and an extremely limited amount of capital flowing into the sector, we have to be very close. There will be a rebound and our goal at RI over the coming months is to position ourselves in the right companies and commodities to benefit from that.

Tax Loss Selling

One of the reasons for the particularly aggressive drop in value across the TSXV over the past two months is tax loss selling. After a crushing year like the one we just had, investors start dumping their stock to lock in losses for the upcoming tax season. This selling pressure adds fuel to the fire pushing an already depressed market further downwards.

Fortunately, this is one of the reasons we typically see rebounds in the first quarter of the new year. Investors start redeploying capital into the markets, sometimes even buying back the stock they just sold.

Scumbags

I pride myself on conducting deliberate and thorough due diligence on the deals covered in RI. We work hard to find the best opportunities, partner with great financiers, and truly understand the technical aspects of the projects.

That said, it feels like half of my job simply comes down to avoiding scams and deals run by scumbags.

Like these guys who appear to have been running quite a profitable little scam on the CSE (Canadian Securities Exchange) in which they “raised” capital for a host of companies, then proceeded to pose as consultants and suck most of the money back in fees. These “consultants” then sold their cheap ill-gotten stock to unsuspecting investors. This excerpt describes the game well:

As an example of what occurred, BCSC outlined how four of the 11 issuing companies (Green 2 Blue Energy Corp., Cryptobloc Technologies Corp., BLOK Technologies Inc. and New Point Exploration Corp.) raised nearly $18 million by privately placing (selling) shares directly to the various BridgeMark members.

The companies then returned $15.3 million to the BridgeMark members in so-called consulting fees, leaving them with $2.7 million. The members, now down $2.7 million, then sold their shares (which were originally issued on a free-trading basis) for $8.8 million, thus raising about $6.2 million in allegedly illicit profit.

Obviously, this resulted in the unexpecting shareholders of these companies getting screwed.

You may at times wonder why I hammer on and on about the importance of knowing and trusting the management team of any company that you consider investing in, this is why.

At RI we invest in people we know and trust, with great reputations, who have done it before.

Portfolio Review

Progress Minerals

Progress has had a busy year. They have been focused on exploring their existing land package, and they have continued to extend their ground. This activity was well summarized in two email press releases sent out by CEO, Adam Spencer, on November 25th, 2018 and December 11th, 2018.

Progress has acquired additional ground in Burkina Faso around the Bira project and completed the earn in on the Bobosso project.

Recent drill results from the Bobosso project are encouraging. The company has completed 7,232m of the planned 7,500m program, the purpose of which is to test 6 targets on the Wendene permit.

As stated in the press release highlights from drilling included:

- BOBRC080: 17m from 91m at 2.21g/t Au, including 1m at 23.24g/t Au; and

- BOBRC083: 8m from 13m at 4.50g/t Au, including 1m at 29.24g/t Au

- BOBRC089: 37m from 32m at 2.54g/t Au, including 1m at 15.37g/t Au and 5m at 5.22g/t Au;

- BOBRC094: 18m from 49m at 3.01g/t Au, including 5m at 8.04g/t Au;

- BOBRC095: 22m from 12m at 1.97g/t Au, including 3m at 4.00g/t Au; and

- BOBRC099: 15m from 39m at 2.47g/t Au, including 1m at 14.43g/t Au;

This is still early days for Progress, but, as they continue to test targets in the region, they are going to be building a more fulsome understanding of the local geology. In this part of the world finding some gold is rarely a challenge, finding it in meaningfully high grades and quantities worth extracting takes work.

The grade Progress is hitting at Bobosso over significant intervals is very meaningful and worth noting. The above mentioned 8m to 22m intervals are promising, as well as grades hitting + 2g/t. The back of the envelope standard used by major miner Newmont in the region is:

(Grade) x( Interval) = +100 is good.

So with: Grade (2.54) x Interval (37) = 94 we’re in the right ballpark.

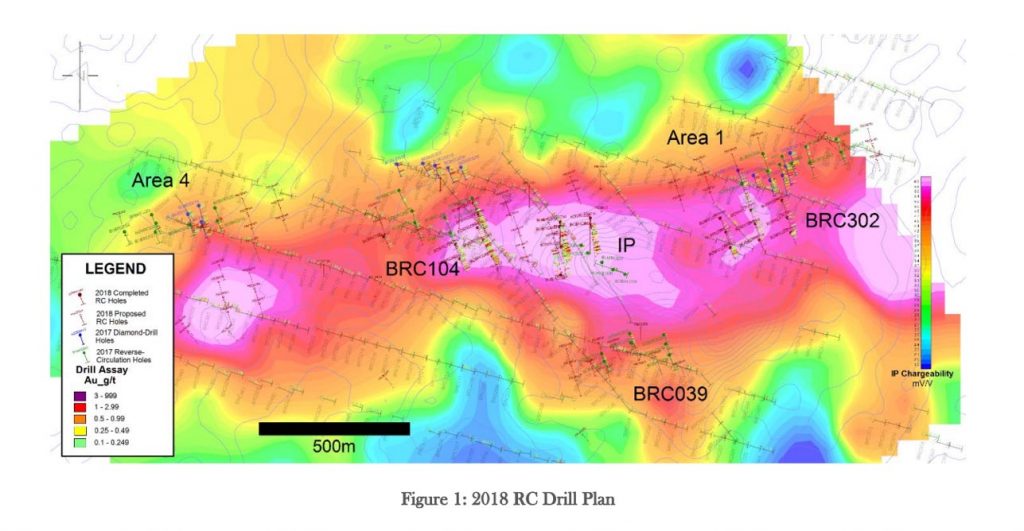

The map provided is atrocious, difficult to read and offer little perspective to readers. The main issue is that one can hardly tell how these results fit into the greater picture.

From what I can tell the high grade sections appear to fall within the IP anomaly in the centre of the map, but with tiny font and a mess of what I assume to be historic holes, it is difficult to really tell.

The IP anomaly appears to be about 500m x 50m. If we assume it has a depth of 200m, an average specific gravity of 2.7 and an average grade of 2 g/t that gives us ~1M oz of gold (500*50*200*2.7*2.0/31.1035 = 868k oz)

That’s not bad, but not big enough for this part of the world. Given the expensive mining and power costs in the region we are realistically we are looking for something in the +3m oz range at +2 g/t.

Based on these results there appears to be a lot of potential at Bobosso, but Progress will need to do better at painting an easily understood picture of what is actually happening on the ground and how these results relate to one another and the surrounding environment.

Next week I’ll be conducting a video interview with Adam to review these results in detail and keep members up-to-date on what to expect from Progress over the coming months.

Resource Insider Uranium Fund SPV

The “Sachem Cove Deal” was successfully closed in November. As members who participated in this opportunity are aware, key changes were made to the structure of the deal. On November 30th, 40% of the SPV’s capital was deployed into the Sachem Cove Uranium Opportunities Fund, managed by Mike Akin.

The remaining 60% of the capital will be deployed over the coming months into opportunities selected and analyzed by Mike and his team, on the same terms and at relative allocations to Sachem. This will be completed free of carry or management fees (with the only fees associated with the fund being expenses paid to Assure). We expect the next investment to be made this week with several others to follow shortly.

Given the improved structure of the SPV, Chris and I are in talks of potentially opening it up for additional investment in 2019. We will keep you posted.

Deals

What We Passed On

Crops Inc. (TSXV:COPS) – A phosphate company being run by one of my favorite people in the mining industry, Simon Ridgway. Unfortunately, I had to pass on this one for several reasons:

Challenging share structure – Sprott owns a great deal of secured convertible debentures and warrants. It’s very difficult to see much runway for new investors if/when those warrants come into the money.

Complex Plan – The plan is to produce a product from phosphate that is highly reactive and closely regulated. It has never been done before in Peru and carries substantial permitting risk.

Phosphate Price – This market is very opaque and I don’t feel confident in a near/medium term price movements. Therefore, I am not willing to risk my capital on it.

I would love to have worked with Simon, but this was not the deal for it.

Fremont Gold (TSXV: FRE) – Gold exploration in Nevada. Small-ish. Too early. Passed.

Contact Gold (TSXV: C) – Gold in Nevada. Great team. Really interesting project. Very cheap (~$0.30), especially when you consider that management put money in at $1.00 a share.

However, I have concerns over their largest shareholder Waterton Global Resource Management (~37%), a private equity firm with a reputation for being ruthless.

Contact was started from projects spun out of Waterton’s portfolio. In exchange for these projects, Waterton received $11M in convertible preferred shares set to mature in mid-2022. These preferred shares are accruing 7.5% per annum and can either be paid back in cash or converted to Contact stock upon maturation. There are limitations in place that state that Waterston cannot own more than 49% of Contact’s outstanding stock following the conversion of the preferred shares.

This is an issue because, at Contact’s current share price, Waterton would be unable to convert a significant portion of the preferred shares and stay under their ownership limits (the share price needs to be +$1.35 to achieve this). Contact does not have the capital to pay in cash which means renegotiation… and that means risk. This risk is offset somewhat by having Goldcorp (15%) as a strategic investor, but at this time not enough for me.

I will be keeping an eye on Contact because I think that the assets are very promising and they continue to turn out great drill results. Though, I will need more assurance that they will be able to successfully manage their relationship with Waterton.

Impact Silver Corp. (TSXV: IPT) – Operating. Very small. Currently unprofitable. I just could not get excited about this one at this time. It will get another run when silver goes up.

Plateau Energy Metals (TSXV: PLU) – Interesting lithium and uranium assets in Peru. Very good management team whom I know well. This is something that I am going to be following closely over the coming months. Right now, I’m going to be watching how they progress with respect to permitting as well as metallurgical test work.

Other – Many other small deals not worth mentioning…

Priority Deals

This is what I’m looking at right now. Both of these have high potential and I’m currently in discussion with the management teams. If things go well, and our due diligence checks out, you will see one or both of these in the near future…

Talon Metals (TSX: TLO) – Extremely interesting nickel sulphide deposit in Minnesota, USA. It is run by an excellent and experienced team. Talon currently has a joint venture agreement to earn into 60% of the Tamarack Project owned by Rio Tinto. This project was brought to my attention by a very good friend at Resource Capital Funds (RCF), the largest shareholder of Talon.

Talon is currently working to raise a minimum of $6M to complete the first stage of their earn in agreement with Rio Tinto. The project is high grade, a good size (potentially very large), and has world class district potential. The very strong shareholders and partners also offer considerable assurance.

Over ~$150M has been spent on this project to date, and it is currently trading at rock bottom prices. The management is extremely motivated to get this deal done, and investors are essentially getting the opportunity to get in on the ground floor.

Right now, I’m trying to assess financing risk. If Talon does not raise the minimum required capital ($6M), what impact will this have on the JV with Rio? Are they going to be able to finance the additional +$30M over the coming 3-5 years to move the project towards production?

I love nickel right now, and I love how cheap Talon is. But, if we decide to cover Talon in RI, we need ensure that we do so at terms that are reflective of the risks involved and market conditions, so that it is favorable to RI members.

Stay tuned.

Northern Vertex (TSXV: NEE) – This is a situation that I would term, “taking advantage of the good works of shareholders past”. Northern Vertex is an operating gold and silver mine in Arizona. The money raised to build this mine was raised in the +$0.60 per share range. Unfortunately, profits have been chocked by a substantial amount of debt and the mine has yet to be unable to achieve full scale production. That looks like it is about to change.

Our friends over at Maverix Metals just purchased a $20M silver stream on the project. In addition, the company’s biggest shareholder, Greenstone Resources, has agreed to pony up an additional $8M in cash. This will wipe out the debt and provide the working capital necessary to complete the ramp up.

The beauty of this situation is that the equity portion of this financing did not come cheap for Northern Vertex. The financing will be completed at $0.24 per unit and includes a full two-year $0.40 warrant.

Northern Vertex is currently trading at $0.25, down from ~$0.70 a year ago. Are existing shareholders going to be happy about this? Nope. But it represents a very compelling opportunity for new shareholders.

My biggest issue with the project is that it is small. I need to better understand what the upside is. But, without the overhanging interest payments and with the injection of new working capital, Northern Vertex could turn into quite a profitable (and undervalued) opportunity. That’s what I’ll be figuring out over the next week.

Conclusion

That’s it for this month. Any comments, questions, or requests for next month’s report please let me know.

Those of you who are Insider members will know that Chris starts every weekly report with a photo of a sunset.

Sunsets are nice and all, but I’m starting a new tradition at RI by ending every report with a photo from a bar. In my line of work, I seem to see a lot more bars than sunsets.

To get the ball rolling, here is one of my favourite “hole in the wall” joints in the Barranco district of Lima, Peru. If you’ve got a snap of one of your favourites, send it through and we’ll feature it in a future report!

Unauthorized Disclosure Prohibited

The information provided in this publication is private, privileged, and confidential information, licensed for your sole individual use as a subscriber. Capitalist Exploits and Resource Insider reserves all rights to the content of this publication and related materials. Forwarding, copying, disseminating, or distributing this report in whole or in part, including substantial quotation of any portion of the publication or any release of specific investment recommendations, is strictly prohibited.

Participation in such activity is grounds for immediate termination of all subscriptions of registered subscribers deemed to be involved at Capitalist Exploits. Capitalist Exploits reserves the right to monitor the use of this publication without disclosure by any electronic means it deems necessary and may change those means without notice at any time. If you have received this publication and are not the intended subscriber, please contact admin@capitalistexploits.at.

Disclaimers

Capitalist Exploits website, World Out Of Whack, Insider, Resource Insider and any content published by Capitalist Exploits is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The information contained in such publications is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. The information in such publications may become outdated and there is no obligation to update any such information. You are advised to discuss with your financial advisers your investment options and whether any investment is suitable for your specific needs prior to making any investments.

Capitalist Exploits and other entities in which it has an interest, employees, officers, family, and associates may from time to time have positions in the securities or commodities covered in publications or the website. Corporate policies are in effect that attempt to avoid potential conflicts of interest and resolve conflicts of interest should they arise, in a timely fashion.

© Copyright 2019 by Capitalist Exploits