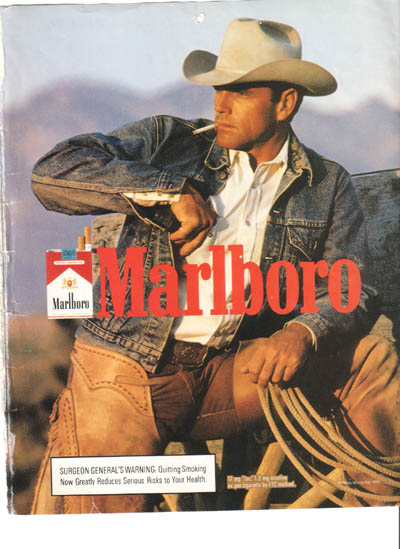

Seems Today’s Oil Stocks Were Yesterday’s Tobacco Stocks

From 1954 to 1999 this guy was on the cover of every magazine. He was also regularly featured in those ads you’d see just before a film kicked off at the cinema. And just in case you never read magazines or watched movies, he was on giant billboards, distracting you